Odomirok.26-Taxes

Reading: Financial Reporting Through the Lens of a Property/Casualty Actuary - Chapter 26 - Taxation in the U.S.

Author: Kathleen C. Odomirok, FCAS, MAAA, Liam M. McFarlane, FCIA, FCAS, Gareth L. Kennedy, ACAS, MAAA, Justin J. Brenden, FCAS, MAAA, EY

Forum (Or click here for Legacy Forum – no longer monitored)

VIDEO → (8:15) → Taxation - General Overview (Click here for all currently available videos.)

BA Quick-Summary: Taxation in the U.S.

|

Pop Quiz

Study Tips

The new version of Odomirok from 2019 incorporates the new tax law passed by Congress effective for tax-year 2018. This represents a significant change from the prior version.

This chapter on taxes is one of the easier chapters. There was a big change for 2021-Spring that made one of the difficult calculation problems much simpler. (The old version required you to calculate the tax implication of dividends which was a messy calculation.)

Under the Tax Cut and Jobs Act of 2017 (TCJA) there is a new calculation called the BEAT (Base Erosion and Anti-Abuse Tax) but it's pretty easy. It has to do with U.S. companies that make tax-deductible payments to foreign companies as a way to reduce their U.S. taxes.

| Altogether, there were 4 important changes for 2021-Spring due to the TCJA (Tax Cut and Jobs Act of 2017): |

- decrease in the corporate tax rate

- cannot use company-specific data to determine payment patterns for discounting

- change how the interest rate is determined

- BEAT calculation (Base Erosion and Anti-Abuse Tax) ← this is probably the most testable of the new information

| For changes in the discounting procedure, click Discounting Loss Reserves for Taxes and look for the yellow boxes. |

Estimated study time: 1 day (not including subsequent review)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- SAP income calculation, both pre-tax and post-tax

- tax basis income, tax rates, discounting loss reserves for tax purposes

- (income tax calculation ← no longer important so don't panic if you see it on past published exams.)

Outdated → questions highlighted in orange are at least partially outdated because they refer to AMIT (Alternative Minimum Income Tax).

reference part (a) part (b) part (c) part (d) E (2018.Spring #14) tax basis income:

- calculate 5E (2017.Fall #21) income tax:

- calculateE (2016.Fall #19) tax rate:

- various income types 3taxable income:

- from SAP incomeincome tax:

- calculateE (2016.Spring #18) discounting reserves:

- for tax purposes 2SAP income:

- calculate pre-tax valuefederal tax:

- identify missing infoE (2015.Spring #17) income tax:

- calculate 1E (2013.Fall #18) SAP income:

- calculate 4bond/stock allocation:

- considerations

- 1 There's a little trick in this problem that's glossed over in the examiner's report. See A Few Old Exam Problems at the bottom of this article for an explanation. (Parts of this problem are outdated, specifically the AMTI calculation and the 'dividends received' deduction. The proration provision has also changed from 15% to 25%.)

- 2 Part (a) of this problem is outdated because under the TCJA (Tax Cut and Jobs Act of 2017) it's no longer permissible for a company to use it's own Schedule P data to derive a payment pattern for discounting.

- 3 This problem is partly outdated because the corporate tax rate changed from 35% to 21%, but you can still do parts (ii), (iii), and (iv) based on the new version of the source text. Part (i) on the 'dividends received' deduction is definitely outdated as this is no longer discussed on the source text.

- 4 Click for an updated solution to 2013-Fall-Q18

- 5 Click for comments regarding discounting in this problem

In Plain English!

Tax-Basis Income

Let's start by looking at the following exam problem. It demonstrates a few of the important formulas and it isn't too hard. It asks you to calculate the tax-basis income. Don't try to solve it for now - Alice's solution is presented in the next section.

- E (2018.Spring #14)

The first question that popped into my mind was:

Question: what is tax-basis income and how is it different from "normal" SAP income

- tax-basis income is SAP or statutory income with a few adjustments:

- ==> EP is adjusted with a revenue-offset

- ==> losses (or reserves) are discounted

The concept of discounting is already familiar, but let's take a closer look at the revenue-offset term. (If you want, you can glance ahead at the TBEP formula which is given in the next section.)

Question: briefly describe the IRS's revenue offset procedure as it applies to tax-basis income

- in SAP, acquisition costs are not deferred so the insurer would incur a loss (because these costs are expensed immediately)

- the insurer would then be entitled to a future tax refund on this loss

- but the IRS wanted to simplify the process: instead of a refund, the IRS reduces UEP liability by 20% for all insurers

- (assumes the acquisition cost ratio is 20% for all lines for all insurers)

Calculating the Tax-Basis Income (Version 1)

Note that the formula provided below for TBI (Tax-Basis Income) is based on past exam problems and does not include quantities that were not provided in the exam problems. In particular, the quantity TBI may include terms such as U/W expense and policyholder dividends but these are not generally provided in typical exam problems on calculating TBI. There is a brief forum post mentioning this.

Let

- TBI = Tax-Basis Income

- TBEP = Tax-Basis EP

- InvInc = Investment Income

- (Strictly speaking, InvInc refers to the taxable portion of InvInc but for this version of the problem, where it's just the compound interest earned on EP, we assume all of this InvInc is taxable.)

- TBIL = Tax-Basis Incurred Loss

then

TBI = TBEP + InvInc – TBIL

where the right-hand-side terms TBEP and TBIL can each be calculated two different ways:

Let

- PL = Paid Loss (during year)

- IL = Incurred Loss (during year)

- LD = Loss reserves after Discounting

- D = Discount amount (= difference between undiscounted and discounted loss reserves)

Then

TBEP = EP + 20% x chg(UEP) = WP – 80% x chg(UEP)

TBIL = PL + chg(LD) = IL – chg(D)

Side Note:

- The formula for TBEP doesn't look like it matches the above description of revenue-offset, but it amounts to the same thing:

- ==> the TBEP formula increases the statutory EP by 20% of the chg(UEP)

Alice's solution to (2018.Spring #14):

- Solution to 2018.Spring #14 ← see this forum post for an alternate way to compute investment income

And here's a practice problem:

The quiz has a practice template for this problem. (In the next section, we'll look at a slightly harder version of calculating TBI.)

mini BattleQuiz 2 You must be logged in or this will not work.

Calculating the Tax-Basis Income (Version 2)

We're going to build on the formulas from the previous section. The following exam problem used to be quite hard but because of a change in the Exam 6-US syllabus for 2021-Spring, it's now much easier. The reason it's easier is that the tax implication of dividend income is no longer covered in the Odomirok source text. Take a quick look at the problem the way it was in 2017 but you can ignore the details on dividend income both in the statement of the problem and in the solution.

- E (2017.Fall #21)

There were 2 things that made this problem harder:

- the calculation of InvInc (Investment Income) required you to know details of how certain bonds are taxed

- → remember that in these problems, InvInc refers only to the taxable portion of investment income

- you were asked to calculate IT (Income tax) which is an extra step (the previous problem asked only for TBI, the Tax-Basis Income, not the actual tax)

We'll examine these 2 items below, but first note the basic corporate tax rate of 21%. This percentage is applied directly to TBI (if TBI = $100 then IT = $21) but there are many, many adjustments. Most of these are not discussed in Odomirok.

First, you should know that in this context, the term proration means to increase taxable income by reducing the deduction for losses incurred by a percentage of certain types of income.

Question: describe the tax adjustments to bonds

- proration of tax-exempt municipal bonds

- ==> add 25% of interest income to TBI

- ==> taxable amounts are then multiplied by the standard corporate tax rate of 21% to obtain the actual tax.

For the exam problem mentioned at the beginning of this section, Alice's solution lays out all the formulas you need. Side note: The solution involves something called RIT (Regular Income Tax) which is the tax obtained by multiplying TBI (Tax-Basis Income) by the standard corporate tax rate of 21%. It is no longer required to calculate AMTI (Alternative Minimum Taxable Income) or AMIT (Alternative Minimum Income Tax)

Alice's solution to (2017.Fall #21):

And here are 2 practice problems.

BEAT or Base Erosion and Anti-Abuse TAX

BEAT is a new tax under the Tax Cuts and Jobs Act of 2017.

Question: what is the purpose of BEAT

- BEAT limits the ability of multinational corporations to shift profits from the United States

- (previously, corporations could shift profits by making tax-deductible payments to affiliates in low-tax countries)

Question: how does BEAT work

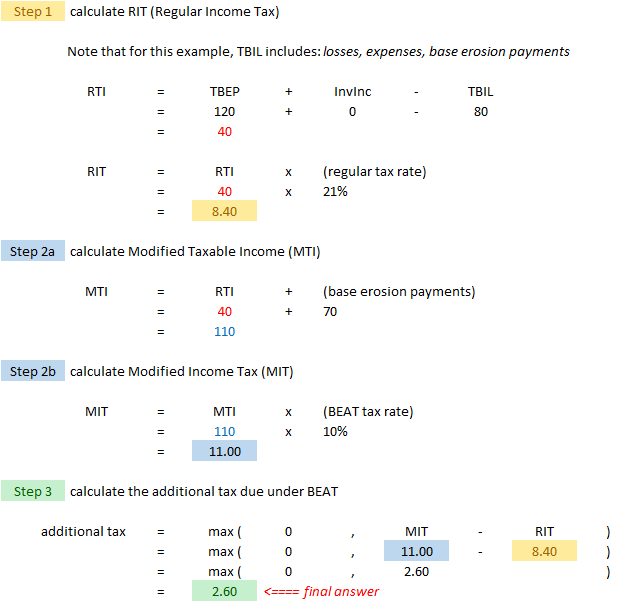

- the corporation calculates its regular tax (as a percentage of taxable income, currently 21%)

- the corporation calculates its alternative tax (as a percentage of gross income, currently 10%)

- if alternative tax > regular tax then the corporation must pay the difference (BEAT = this difference)

Another way of describing BEAT is that it is a minimum tax add-on. Here's an example to illustrate the concept:

- Suppose for the years 2020-2022, a US corporation has $600 million of gross taxable income per year. For tax year 2022, the corporation also pays $400 million in tax-deductible royalties to a foreign affiliate. The corporation’s regular tax liability is ($600 - $400) x 21% = $42 million. Its alternative tax is $600 x 10% = $60 million. The corporation must then pay $60 million to the United States (regular tax of $42 million plus the BEAT of $18 million.)

Not all U.S. corporations are subject to BEAT however. The following conditions must be satisfied for a corporation to be potentially subject to BEAT:

- insurer is part of a U.S. group of companies with average gross receipts in the past three years ≥ $500M

- insurer makes base erosion payments ≥ 3% of the total deductions taken by the U.S. group on its current tax return.

Again, BEAT is a type of minimum tax that is added to the regular tax liability. Note however that if the foreign company to which tax-deductible payments have been made has elected to be taxed as a U.S. taxpayer then the U.S. corporation or insurer is not subject to BEAT. That seems like a little trick they might throw at you on the exam. So pay attention! (Maybe they'll give you information on 2 companies that made foreign payments but where only 1 of them is subject to BEAT because the other doesn't satisfy the conditions described above.)

Pop Quiz A! :-o

- In which of the following situations would the insurer be potentially subject to BEAT:

- Situation 1:

- average gross receipts in past 3 years is $550 million

- insurer makes base erosion payments of 4% of the total deductions taken by the U.S. group on its current tax return

- base erosion payments were to a foreign company that is not taxed as a U.S. taxpayer

- Situation 1:

- Situation 2:

- average gross receipts in past 3 years is $400 million

- insurer makes base erosion payments of 4% of the total deductions taken by the U.S. group on its current tax return

- base erosion payments were to a foreign company that is not taxed as a U.S. taxpayer

- Situation 2:

- Situation 3:

- average gross receipts in past 3 years is $550 million

- insurer makes base erosion payments of 2% of the total deductions taken by the U.S. group on its current tax return

- base erosion payments were to a foreign company that is not taxed as a U.S. taxpayer

- Situation 3:

- Situation 4:

- average gross receipts in past 3 years is $550 million

- insurer makes base erosion payments of 4% of the total deductions taken by the U.S. group on its current tax return

- base erosion payments were to a foreign company that is taxed as a U.S. taxpayer

- Situation 4:

Below is the example from the text. It's very easy. (And below that are a couple of practice problems.)

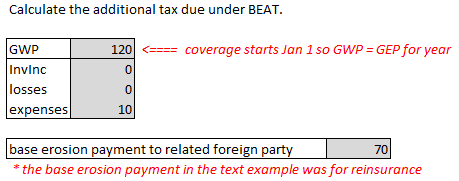

| Here's the problem... |

| Here's the solution... |

Here are a couple of really easy practice problems.

Discounting Loss Reserves for Taxes

Let's start with a very important distinction regarding discounting:

Question: explain the difference between a company's own estimate of discounted reserves versus the estimate derived for tax purposes

- Even though reserves are reported at their nominal value on the balance sheet, every company is primarily interested in the economic impact of their assets & liabilities (versus the purely statutory impact). Obviously the company wants to ensure that its assets are sufficient to support its liabilities, but if you know you have $1,000 of liabilities due in 1 year, you don't need to set aside $1,000 of assets at the beginning of the year. If you think your assets will earn 10%, then you only need to set aside $1,000/1.1 = $909. This is an economic calculation.

- But the calculation is different for taxes. The discount rate applied to this $1,000 for tax purposes is calculated according to the procedure below and probably won't be the same as the discount the company used in their economic calculation.

This is the final section from chapter 26 of Odomirok and there is a lot of overlap with Feldblum.Discount. Note however that Feldblum's reading was removed from the syllabus for the 2019-Fall sitting. Does this mean the topic of discounting is less important than it was? In other words, do you still have to study this topic? Well, there's no way to predict. My suggestion is that you get a basic understanding of discounting facts and calculations, but if you are pressed for time, you could consider giving that topic a slightly lower priority versus other topics we know are important.

First, let's recall our earlier discussion of discounting as it related to the Fair Value of the Liabilities. That was discussed in Chapter 23 Purchase GAAP. Discounting was component #2 of the Fair Value of the Liabilities. As a reminder, component #1 was future cash flows and component #3 was the risk margin. These components were asked on an exam question in 2017, so make sure you know them.

Anyway, the first paragraph in the discounting section in chapter 26 has another bullet point list you have to memorize:

Question: what 3 components are required to calculate discounted loss reserves (for tax purposes)

- undiscounted loss reserves

- discount rate for the AY reserves to be discounted (use U.S. Treasury rate)

- payment pattern

Actually, that list is pretty obvious. If you simply know how to calculate the discounted reserves, you could come up with those components. We'll cover the calculations below, but there are a few more dull facts you have to know.

| 2021-Spring: Information regarding the components of discounting has changed. |

Question: where do you get these 3 components for discounting (for tax purposes)

- undiscounted loss reserves:

- - Schedule P, Part 1

- - note that Part 1 is net of tabular discount, but gross of nontabular discount (means that any tabular discount must first be eliminated to get the true undiscounted reserves)

- discount rate:

- - NEW: based on the corporate bond yield curve (determined by the U.S. Treasury for each accident year)

- - (no longer valid: 60-month moving average of Federal midterm rates for each AY)

- payment pattern:

- - use Schedule P, Part 1 from industry data (IRS does the calcs for you. Thanks IRS!)

- - (no longer valid: using Schedule P, Part 1 from company data)

Aside from the actual discounting calculation, there's only 1 more thing that you might want to look at (then you can pretty much just skim Feldblum.Discount in about 5 minutes. There is no real content, only a couple of old exam problems you might want to glance at. I didn't remove Feldblum completely because it overlaps so much with the tax chapter from Odomirok.)

Question: why is the payment pattern derived from Schedule P, Part 1 instead of Part 3 (for tax purposes)

- Part 3 may be skewed because it doesn't include adjusting/other expenses

- Part 3 is not audited (Part 1 is audited)

- Part 1 requires no judgment for the IRS method

| 2021-Spring: Calculating the discount factor using company Schedule P data is no longer covered in the current version of Odomirok and should not be tested. |

Ok, we're finally at the fun part where we calculate the discount factor from Schedule P, Part 1 data. On the exam, this calculation is usually part of a bigger problem but the other parts of the problem are covered elsewhere so we'll focus here on the discount factor calculation. Once you have the discount factor, say it's 80.2% or something, you just multiply it by the undiscounted reserves, say that was $1,000, to get the discounted reserves of $802. Anyway, here's an exam problem where you have to calculate the discount factor. Below that, Alice has provided her own solution to the discounting calculation and then a few random practice problems.

- E (2016.Spring #18)

Details of discounting calculation from above exam problem:

- Solution to 2016.Spring #18 (discount calc only) ← as of 2021-Spring, this calculation should no longer be tested

Random practice problems on calculating the discount factor:

- 4 discounting practice problems like 2016.Spring #18 ← as of 2021-Spring, this calculation should no longer be tested

A Few Old Exam Problems

Here are a a few remaining exam problems for extra practice, but first here's a quick explanation of the trick in:

- E (2015.Spring #17)

- Part of the solution involves calculating RTI (or TBI).

- The standard formula is: TBI = TBEP + InvInc - TBIL

- You can calculate InvInc using the methods discussed above, but the trick involves getting the value for TBEP - TBIL

- You are not given TBEP. Instead you are given U/W profit. Recall the U/W profit formula from Chapter 8.

- U/W profit = EP - IL

- so

- EP = U/W profit + IL

- U/W profit = EP - IL

- also: TBEP = EP + 20% x chg(UEP)

- and: TBIL = IL - chg(resv disc)

- Putting this all together gives:

- TBEP - TBIL

- = [ U/W profit + IL + 20% x chg(UEP) ] - [ IL - chg(resv disc) ]

- = U/W profit + 20% x chg(UEP) + chg(resv disc)

- TBEP - TBIL

The other piece of RTI is InvInc which is given in the examiner's report as:

- ==> (taxable InvInc) + (realized gains)

Then the rest of the solution isn't too bad, but the part about AMTI or Alternative Minimum Taxable Income is now outdated, as is the part about the dividends received deduction. (See examiner's report.)

mini BattleQuiz 5 You must be logged in or this will not work.

Full BattleQuiz You must be logged in or this will not work.

POP QUIZ ANSWERS

Pop Quiz A - Answer

- Situation 1: potentially subject to BEAT because all conditions are satisfied

- Situation 2: not subject to BEAT because average gross receipts over last 3 years < 500M

- Situation 3: not subject to BEAT because base erosion payments < 3% of tax-deductible payments to foreign company

- Situation 4: not subject to BEAT because foreign company to which tax-deductible payments were made is taxed as a U.S. taxpayer