Odomirok.16-17-SAO

Reading: Financial Reporting Through the Lens of a Property/Casualty Actuary - Chapter 16 & 17 - Statement of Actuarial Opinion & Actuarial Opinion Summary Supplement

Author: Kathleen C. Odomirok, FCAS, MAAA, Liam M. McFarlane, FCIA, FCAS, Gareth L. Kennedy, ACAS, MAAA, Justin J. Brenden, FCAS, MAAA, EY

Forum (Or click here for Legacy Forum – no longer monitored)

VIDEO → (8:45) → SAO - General Overview (Click here for all currently available videos.)

BA Quick-Summary: Chapter 16/17: Statement of Actuarial Opinion

|

Pop Quiz

Notes:

- The Pop Quiz below is a comprehensive multiple choice review of the Statement of Actuarial Opinion (SAO).

- The Battle Cards in the quiz are categorized under the wiki article ASOP.36 which is the Actuarial Standards of Practice for the SAO.

- The wiki article ASOP.36 is a very short article.

- The bulk of the material on the SAO is in the wiki article COPLFR.SAO.

Multiple Choice (ASOP 36 - mini BattleQuiz 2) ← for general review of topic

Study Tips

| Click to meet Alice-the-Actuary This is a hard exam so I've asked Alice and some of her friends to stop by from time to time to help you out. You'll learn more about them as you work your way through the wiki articles. I've also hidden an Easter Egg somewhere in the wiki with Alice's bio. See if you can find it. :-) |

Chapters 16 & 17 from the CAS Financial Reporting text by Odomirok et al cover the opinion of a qualified actuary on the reasonableness of the loss & LAE reserves as of December 31 each year. This opinion is known as the SAO or Statement of Actuarial Opinion and is the most heavily tested topic on the syllabus. It accounts for about 1/6 of the total points on every exam. There are 3 sources of information on the SAO listed in the syllabus:

Chapters 16 & 17 from Odomirok provides a nice introduction to the SAO COPLFR.SAO this is the most important source of information on the SAO ASOP.36 a very short article on the SAO that contains very little new information

You should spend a couple of days on chapters 16 & 17 of Odomirok but note that this is intended as an introduction. The main source for the SAO material is COPLFR.SAO and although it is well written, it is 120 pages, very detailed, and may be difficult to start with. Chapters 16 & 17 of Odomirok will give you an nice overview before you dive into COPLFR.SAO.

As a general observation on the Exam 6 syllabus, the Odomirok text (which is 450 pages!) primarily covers accounting principles and over 1/3 of the points on the exam come from this source. The SAO (Statement of Actuarial Opinion) by itself accounts for another 1/6 of the points on the exam. That means that accounting principles together with the SAO account for 1/3 + 1/6 or roughly 50% of the total points. This means at least half your total study hours should be spent on these 2 readings alone.

Estimated study time: a couple of days (for chapters 16-17 of Odomirok)

| Source Readings: BattleActs includes all material from past exams in at least 1 of the elements of the system: wiki articles, BattleCards, BattleTables. It also covers significant material that has not appeared on past exams but that I've judged to be important. Still, it's a good idea to spend a portion of your time reviewing the source readings. You may have a different opinion on what's important and what you can skip. You cannot read all 2,500 pages in depth, but BattleActs give you the necessary background knowledge so that the time you do spend on the source readings will be much more efficient. For a little more on this click on Using the Source Material. |

BattleTable

| For each syllabus reading, Alice-the-Actuary has compiled previous exam questions into a "BattleTable". You can use this to easily see which topics are tested most frequently. There are also direct links to the specific question and answer from the examiner's report. (This provides a more efficient way to review old exam problems because the question and answer are grouped together, versus having to scroll down 20 or 30 pages from the question to see the answer.) |

Based on past exams, the main things you need to know (in rough order of importance) are:

- for the SAO (Statement of Actuarial Opinion):

- purpose and organization of opinion

- types of opinion, standardized language for opinion

- information about the appointed actuary that must be disclosed

- when a company is exempt from providing a SAO

- for the AOS (Actuarial Opinion Summary):

- audience for AOS

- construct exhibits A,B,C,D,E

| Note that in the table below, you can click E in the left-hand column to open a PDF with the question and answer from the examiner's report for just that question. |

reference 1 part (a) part (b) part (c) part (d) E (2017.Fall #22) SAO opinion:

- propose languageSAO opinion:

- type of opinionAOS (A,B,C,D):

- construct exhibit— E (2016.Fall #22) appointed actuary:

- standards forappointed actuary:

- info in SAO (id section)appointed actuary:

- info to regulator (new appointment)— E (2016.Fall #24) AOS:

- construct items A-E— — — E (2013.Fall #27) qualified actuary:

- definitionlong-duration contract:

- definitionSAO exemption:

- financial hardshipRMAD:

- necessary disclosures

- 1 This table is a little different from the tables in subsequent wiki articles. In this article, we'll be focusing on the green highlighted boxes and postponing the grey highlighted boxes for later. All of these exam problems are also included in the BattleTable for COPLFR.SAO.

In Plain English!

Intro

| Alice's Fun Fact: All of the information you need is contained in the COPLFR.SAO reading. |

As mentioned in the Study Tips above, the SAO, or Statement of Actuarial Opinion, is by far the most important topic on the syllabus. Theoretically you could skip chapters 16 & 17 in Odomirok as well as ASOP.36 because the COPLFR reading has everything you need to know. Alice's advice however is to start with chapters 16 & 17 from Odomirok. Then when you get to COPLFR.SAO, it won't seem so intimidating.

Plan of Attack

- Getting Started: Read the brief section titled PART IV (Filings to Accompany Annual Statement) Ch 16-20 to familiarize yourself with general reporting requirements for an insurer.

- Next Steps: Work your way through this wiki article starting with Statement of Actuarial Opinion.

- Be sure to go through BattleQuizzes. These quizzes generally contain 5-10 "BattleCards" (flashcards) which are designed to encourage active reading versus passive reading. Active reading takes more effort but has been shown to increase recall.

- You don't have to perfectly memorize all the details in the BattleCards the first time through. You will gradually absorb the details as you work through the old exam problems but note that Exam 6 is very heavy on memorization and you'll need to drill yourself relentlessly on memory items over the course of your study if you want to be properly prepared on exam day. The #1 reason for failing exam 6 is not spending enough time memorizing.

- Before moving on to COPLFR.SAO, you definitely should have memorized the purpose and organization of the SAO, and the basic organization of the AOS. Other memory items can be learned gradually over time, as you work through COPLFR.SAO.

- Next Challenge: After finishing this wiki article, you can proceed to the next article in the ranking table: COPLFR.SAO.

| Quiz scoring: Your "BRQ-points" (Battle-Readiness Quotient) for a particular BattleCard are shown in red font to the left of your username in the navigation bar in the main part of the site. Sometimes, this score shows as 0 when it should be non-zero. This is due to web traffic, but the database does record the correct score. If you click the "check" or "x" button again, you should then see the correct non-zero score in the navigation bar. |

PART IV (Filings to Accompany Annual Statement) Ch 16-20

The Annual Statement includes the balance sheet, income statement, Schedule P (actuarial triangles), Schedule F (reinsurance), and many other exhibits, schedules, and notes. It is filed with the state department of insurance. Note that the NAIC itself (National Association of Insurance Commissioners) is not a regulator, rather it coordinates regulation of insurance across the U.S.

Unfortunately, filing requirements for insurers don't end with the Annual Statement. There are many more items covered in Part IV. All of this paperwork seems like a lot of bureaucracy but it's all part of a well-developed regulatory system. Without a good regulatory system, we'd have periodic insolvencies and financial crises. (Actually, we do have financial crises quite regularly. Maybe our regulatory systems need improvement, but that's a discussion for another time.)

Anyway, some of the more common documents that have to be filed with state insurance regulators are:

- SAO (Chapter 16: Statement of Actuarial Opinion)

- AOS (Chapter 17: Actuarial Opinion Summary Supplement)

- IEE (Chapter 18: Insurance Expense Exhibit)

- RBC (Chapter 19: Risk-Based Capital)

- IRIS Ratios (Chapter 20: Insurance Regulatory Information System)

The first two, SAO and AOS are covered in this article. The remaining three are covered later. Note the filing requirements of each:

- SAO: included with the Annual Statement that's sent to the state insurance department

- AOS: filed with domiciliary state (if required by the particular state) and separately from the SAO, because the AOS is a confidential document that contains proprietary information

Chapter 16 (Statement of Actuarial Opinion)

Intro

If we're going to go to the trouble of providing an actuarial opinion, we might as well know why we're doing it.

Question: what is the purpose of the SAO (Statement of Actuarial Opinion)

- There are 3 items: OIA

- Opinion: provide the appointed actuary's opinion on reserve amounts for items in SAO scope (whether the reserves are reasonable, inadequate, excessive...)

- Inform: inform readers/regulators of significant risk factors regarding reserves

- Advise: advise whether risk factors could lead to MAD in reserves (MAD = Material Adverse Deviation)

- Alice told me this very short story: If you advise that certain risks may lead to Material Adverse Deviation in the reserves, management might get MAD. (It's just a dumb little memory trick to help you remember all this dull information!)

Question: describe the organization of the SAO

- The SAO consists of 4 sections, and 2 exhibits: ISOR + (A,B) (details in next section)

- Identification

- Scope

- Opinion

- Relevant comments

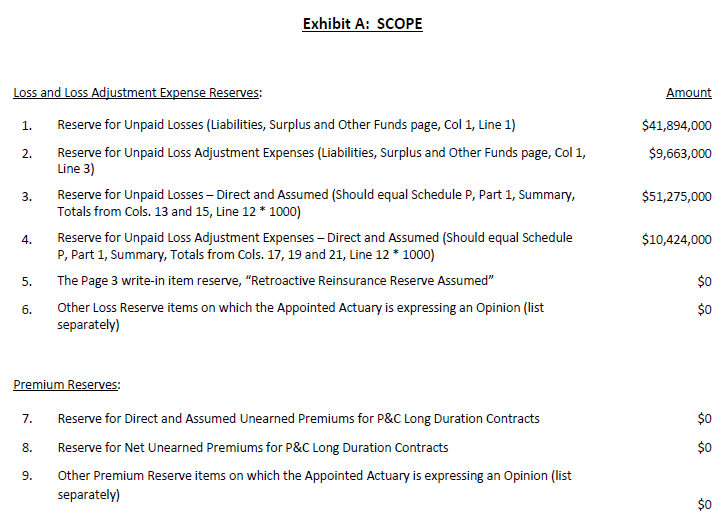

- Exhibit A: recorded amounts for items in scope (loss reserves, reinsurance...)

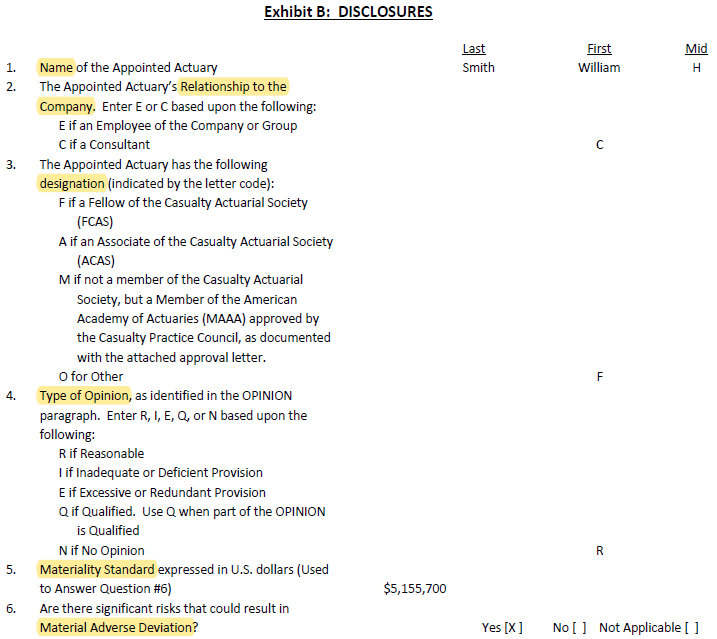

- Exhibit B: disclosure items regarding NET reserves in scope

- (To me, ISOR sounds like eyesore, which may happen to you from time to time while studying because there is a lot of reading.)

And here is one last item for the intro to chapter 16...

Question: how might an insurer get an exemption from filing the SAO

- Here are the possible reasons: SLuSH

- Size: the insurer is small (less than $1m annual GWP) & (less than $1m gross reserves @ year-end)

- LOB: certain lines of business are exempt

- (u: doesn't stand for anything, but I needed a vowel to make the memory trick SLuSH into a word. Actually, check out DB's forum post!!)

- Supervision: exempt if insurer is under supervision

- Hardship: if insurer is under financial hardship (cost of SAO is a burden) E (2013.Fall #27)

- The answer to the above exam problem is in the first appendix of the COPLFR.SAO source reading, Section 1B. An insurer may qualify for financial hardship if the cost of the SAO exceeds the lesser of:

- 1% of CY capital & surplus (from latest quarterly statement)

- 3% of GWP for year (projected from last quarterly statement)

This question was from 2013 and has never been asked again. (You can do a control-f search on the COPLFR BattleTables to find all instances of the "exemption" topic, or any other topic.) Now that you know how the SAO is organized, below is a link to an example SAO prepared by Mr. Smith of Fictitious Insurance Company. Take a moment to look through it, and keep it handy. We'll cover the details in the next few sections.

- Mr. Smith's SAO Note the layout: (SAO is 8 pages, AOS is 2 pages and the link to the AOS is in the next section.)

- SAO page 1-5: contains ISOR (Identification, Scope, Opinion, Relevant Comments)

- SAO page 6: shows Exhibit A (recorded amounts for reserves)

- SAO page 7-8: shows Exhibit B (disclosure items)

And in the next section, you'll see the AOS:

- AOS page 1-2: show the actuary's estimates (this is not shown in the SAO)

| Quiz Scoring (reminder): Your "BRQ-points" (Battle-Readiness Quotient) for a particular BattleCard are shown in red font to the left of your username in the navigation bar in the main part of the site. Sometimes, this score shows as 0 when it should be non-zero. This is due to web traffic, but the database does record the correct score. If you click the "check" or "x" button again, you should then see the correct non-zero score in the navigation bar. |

mini BattleQuiz 1 You must be logged in or this will not work.

The Boring Details (Yawn)

When you read the source text, you should always be assessing the likelihood of that material being on the exam. That's hard to do on your first pass because you don't have a sense for what's important and what isn't. Let me help you out: The Statement of Actuarial Opinion is consistently and heavily tested. You have to know pretty much all the details. For less important topics, you can skip large swaths of material, but that is not the case with the SAO.

The wiki articles explain the material and provide many of the details you need to learn but there are also some facts that are provided only in the BattleCards. This avoids duplication and keeps the wiki articles relatively short. (If the wiki articles listed every detail, they would end up being as long as the source reading and that would defeat the purpose of the wiki.)

From the previous section, we know how the SAO is organized: ISOR + (A,B). Here we delve into the details. Alice and her minion Ian-the-Intern put together the following table to help you understand the structure of the SAO. Don't worry if you feel a little overwhelmed at this point. The SAO is a very long and detailed document. For now, just try to grasp the overall idea. We'll go much further into the details in COPLFR.SAO.

For a nifty mnemonic for remembering the different parts of the Identification section, see this forum post!

section contents Alice's helpful comments Identification - actuary's name/title + WARD

- Who made appointment

- Affirmation of qualifications

- Relationship to company

- Date of appointment

- intended purpose/users (ASOP.36, section 3.2)this one is easy! Scope must identify:

- reserve items in opinion

- accounting basis for reserves

- review date (also defined in ASOP 36)

- data sourcesee BattleCards for further details:

- examples of typical reserve items

- defn of 'review date'

- data reconciliation statementOpinion [A] & [B]: statements about laws & actuarial standards

[C]: type of opinion: R, I, E, Q, or N 1

[D]: miscellaneoussee BattleCards for further details:

- 5 types of opinion

- required wordingRelevant Comments - comments & disclosures to aid reader's understanding

- items 1&2 (of 8): MAD (Material Adverse Deviation)

- materiality standard regarding MAD

- risks that may result in MAD

- items 3-8: varioussee BattleCards for further details:

- items 1 thru 8

• memory trick

• Another memory aid for disclosuresExhibit A recorded amounts for items mentioned in the scope 6+3 items (see below for Mr. Smith's example) Exhibit B disclosure items regarding NET reserves in the scope

(these disclosure items include type of opinion)14 items (see below for excerpt of Mr. Smith's example)

- 1 The 5 types of opinion are Reasonable, Excessive, Inadequate, Qualified, None (they are defined in the quizzes below.)

- → If you'd like a memory hint for these opinions, I reckon you can click here to go to a post by Sharmishtha or amberxmc in the forum!

| Here is Exhibit A from Mr. Smith's SAO: |

| Here are the first 6 of 14 disclosures in Exhibit B from Mr. Smith's SAO: (Click here for Complete Version of Exhibit B) |

| Before I let you loose on the mini BattleQuiz, take a look at this exam problem: |

- E (2016.Fall #22).

The answer to part (b) of this exam question is in the table above. The answers to part (a) & (c) will covered later in COPLFR.SAO, but it's good to start getting a feel for the types of questions that are asked. Something confusing: The "contents" of the OPINION section are labelled [A], [B], [C], [D], but these are different from Exhibits A & B. This labeling is consistent with the presentation in COPLFR.SAO – but I wish COPLFR had used different letters for the contents of the OPINION section.)

mini BattleQuiz 2 Identification & Scope

mini BattleQuiz 3 Opinion

Before charging ahead to the next section, take a peek at:

- E (2017.Fall #22).

You can answers parts (a) & (b) from what we've covered so far. Part (c) deals with the AOS, which we cover later in this wiki article. It's a good question because it ties things together.

Miscellaneous

We'll close chapter 16 with a few words on the Relevant Comments section of the SAO. This is the longest part of Mr. Smith's SAO and the most important part of it relates to the materiality standard for assessing the risk of MAD (Material Adverse Deviation). I'm assuming you have some familiarity with the concept of materiality but if you want a quick refresher, take a look at the short wiki article AAA.Materiality. Anyway, in the Relevant Comments section of the SAO the actuary must report on:

- significant risks and uncertainties that could result in material adverse deviation

To do that, the actuary must first have a numerical value for the materiality standard. As a really dumb example, if the actuary sets the materiality standard at $1, then every little random variation would be considered material, which would be silly. At the other extreme, if the materiality standard is set a $1 trillion then nothing will be material. We need a way of coming up with something more reasonable and useful in between these extremes.

Question: identify common methods for selecting a materiality standard (this is item 1 in the Relevant Comments)

- percentage-based standards:

- % of loss & LAE reserves (10% is typical & reasonable)

- % of surplus (10-20% is typical & reasonable)

- % of net income ← this standard was not accepted in E (2014.Fall #22) although I believe the examiners' report was incorrect in stating this

- percentage-based standards:

- regulatory ratio based standards:

- reduction in surplus that would trigger the next RBC action level (See also Odomirok.19-RBC)

- amount that would trigger an unusual IRIS ratio (See also NAIC.IRIS)

- regulatory ratio based standards:

- There's a good example from the text p196-197 involving the actuary Mr. Smith. To see it, click Mr. Smith's adventures in materiality.

Note that the materiality standard could be based on both quantitative and qualitative considerations.

Question: how is the materiality standard used within the SAO (this is item 2 in the Relevant Comments)

- The materiality standard is used to examine risk factors that could lead to MAD.

Pop Quiz! :-o

- Given:

- Mr. Smith has identified 2 major risk factors: mass tort claims, catastrophic weather events

- His range of reasonable reserves estimates is (95m, 105m), with a point-estimate of 100m. (Assume his point estimate equals the carried reserves.)

- Given:

- What would he disclose about these risks in the relevant comments section of the SAO if...

- materiality standard = 4m

- materiality standard = 7m

- What would he disclose about these risks in the relevant comments section of the SAO if...

- Answer:

- there are significant risks and uncertainties that could lead to MAD in the recorded reserves (because a reserve level of 105m is reasonable and the deviation from the carried reserves would be 5m, which is greater than the materiality level of 4m)

- there are not significant risks and uncertainties that could lead to MAD in the recorded reserves (because the worst reasonable scenario is 105m which is a deviation from carried of 5m, but is less than the materiality level of 7m)

- Answer:

Final Question: what about the other disclosure items in Exhibit B

- Unfortunately, Mr. Smith has to comment on those as well. Things like salvage & subrogation, reinsurance collectability, claims-made or retroactive reinsurance (thx TC!) IRIS ratios etc...

There are a lot of details in the SAO, but this gives you the foundation. (And don't forget to sign the darn thing when you're finished. Submit with Annual Statement by March 1, assuming a Dec 31 year-end, and put in writing that you'll keep all supporting docs for 7 years.)

There's an alternate mnemonic for the second question in this quiz that asks for the item required in the Relevant Comments section. See this forum post.

mini BattleQuiz 4 Relevant comments → memory trick

Chapter 17 (Actuarial Opinion Summary Supplement)

Alice the Actuary has a math joke for you : This chapter is easy as π. :-)

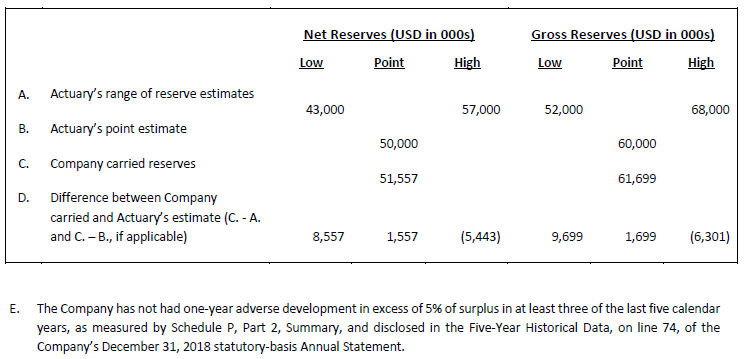

The AOS, as it's called, is barely two pages long. Odomirok has provided Mr. Smith's AOS for a fictitious insurer. It has 5 items (A through E).You can see it here: Mr. Smith's super-awesome AOS. (Since this link opens in the same browser tab as the wiki, you might want to right-click and duplicate this tab to make it easier to toggle between views.)

Question: who is the intended audience for the AOS

- file with regulators of the domiciliary state (Note: do not file AOS with NAIC)

- (the AOS is not a public document because it contains proprietary company information)

Question: how is the AOS organized (Hint: I like to think of it as consisting of 2 things.)

- Thing 1: (comparison section, 4 items)

- A: range of actuary's reserves, if the actuary calculated a range, otherwise a range is not required (case + IBNR on net & gross basis for all items)

- B: point estimate by actuary

- C: carried reserves by company

- D: difference (company – actuary)

- Thing 1: (comparison section, 4 items)

- Thing 2: (adverse development section, 1 item) (Click for mnemonic!)

- E: statement regarding whether there has been: 1-year adverse development (relative to prior year surplus) greater than 5% in 3 of last 5 calendar years

- if there hasn't been → best practice is for the actuary to state this fact (although no comment is specifically required)

- if there has been → actuary should provide sufficient detail so the regulator can determine whether additional regulatory review is required

- If you know about IRIS ratios, you'll see you're really just calculating IRIS Ratio 11.

- E: statement regarding whether there has been: 1-year adverse development (relative to prior year surplus) greater than 5% in 3 of last 5 calendar years

- Thing 2: (adverse development section, 1 item) (Click for mnemonic!)

- Possible point of confusion: The SAO includes two exhibits called Exhibit A & Exhibit B, but they are different from items A & B in the AOS. (Alice the Actuary would have definitely used different letters for the AOS to make it less confusing.)

| Here is Thing 1 (items A, B, C, D) and Thing 2 (item E) from Mr. Smith's AOS |

| Another way of thinking about the AOS is that it provides more detailed information about the actuary's work that the company may not want to be made public. |

Pop Quiz! :-o

- Question: Where in the Annual Statement is the adverse development of reserves disclosed?

- Answer:

- Five-Year Historical Data, line 74 (statutory basis Annual Statement)

- (the raw data comes from Schedule P, Part 2 - Summary)

Question: if there has been adverse development, how could item E in the AOS be worded

- Odomirok has a great example of how Mr. Smith did this. He organized his statement as follows:

- state that there has been adverse development and for which years

- summarize the reason for the adverse development (strengthened loss reserves)

- explain the reason in more detail (increased exposure – various specific reasons are given)

- mitigate the effects of this adverse development (purchase unaffiliated retroactive reinsurance)

- Odomirok has a great example of how Mr. Smith did this. He organized his statement as follows:

- Click here and start reading at the yellow highlight to see his wording and the regulator's possible response: Mr. Smith's well-written item E statement

Before you charge into the mini BattleQuiz, take a look at:

- E (2016.Fall #24).

This is a great question to teach you how to construct items A-E of the AOS.

mini BattleQuiz 5 You must be logged in or this will not work.

Full BattleQuiz You must be logged in or this will not work.