Odomirok.19-RBC

Reading: Financial Reporting Through the Lens of a Property/Casualty Actuary - Chapter 19 - Risk-Based Capital

Author: Kathleen C. Odomirok, FCAS, MAAA, Liam M. McFarlane, FCIA, FCAS, Gareth L. Kennedy, ACAS, MAAA, Justin J. Brenden, FCAS, MAAA, EY

VIDEO → (6:15) → RBC - General Overview (Click here for all currently available videos.)

BA Quick-Summary: Risk-Based Capital (RBC)

|

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Alice's 1st Day (Intro to RBC)

- 4.2 Alice's 2nd Day (Trend Test & Risk Categories)

- 4.3 Alice's 3rd Day (Ranking of Risk Charges)

- 4.4 Alice's 4th Day (An Exam Problem.)

- 4.5 Alice's 5th Day (R0 and Another Exam Problem)

- 4.6 Week 2: Day 1 (R1)

- 4.7 Week 2: Day 2 (R2)

- 4.8 Week 2: Day 3 (R3 with intro to R4)

- 4.9 Week 2: Day 4 (R4)

- 4.10 Week 2: Day 5 (R5)

- 4.11 Week 3: Day 1 (Catastrophe Risk)

- 4.12 Week 3: Day 2 (Operational Risk)

- 4.13 Alice's Summer Performance Review (Old Exam Problems)

- 5 Pop Quiz B Answers

- 6 Pop Quiz C Answers

Pop Quiz

Multiple Choice (mini BattleQuiz 8) ← for general review of topic

Study Tips

| BattleActs Coffee Mug Challenge! Alice has double-checked her RBC calculations but if you find an RBC calculation error that slipped past her, please let her know in the RBC Discussion Forum and we'll send you a BattleActs coffee mug. |

| Updates for 2021.Spring are COMPLETE: There were significant changes. (There were no changes for 2021.Fall.) |

For candidates who attempted Exam 6 prior to 2021.Spring, there are some new things you have to learn regarding the RBC calculation: (Details are contained in the wiki article.)

- new risk category: catastrophe risk

- new risk category: operational risk

- new RBC formula: includes catastrophe risk and operational risk

- new R0 calculation: this isn't too hard

- new R3 calculation: the portion of the R3 RBC charge for reinsurance recoverables is different

There are also minor changes to the R1 and R2 material but the text examples and old exam problems on those topics were not affected. There were no changes to the R4 and R5 calculations.

For all candidates, some exam problems published prior to 2021.Spring are outdated. These include problems regarding:

- total RBC charge or RBC ratio

- RBC charges for R3

The new RBC formula affects many old exam problems but they are still solvable if you assume that both the catastrophe charge Rcat and the operational risk charge equal 0. The previous edition of Odomirok did not cover the details of the R0 calculation so there are no old exam problems for that. Any problems on R3 that involve reinsurance recoverables will not be completely solvable anymore but there are only 2 of those: E (2016.Spring #26) and E (2014.Spring #20).

And remember → you can generate an infinite number of web-based practice problems for a broad range of RBC problem types so you don't need to rely solely on old exam problems for practice.

| Here are the "regular" study tips: |

The RBC chapter is like Schedule P in that the questions are mostly calculation, but RBC has more different types of calculations. This wiki article includes lots of problems for you to practice on and it's going to take a lot of time to go through them all. In addition to the problems provided in pdf format within the wiki, and in Excel format available here, you should do the randomly generated web-based problems from the quizzes until you consistently get the right answer. Since this is a Top 6 reading, you should also do as many of the old exam problems as you can, keeping in mind the above comments regarding changes to the RBC formula.

The source text (Chapter 19 of Odomirok), which is 60+ pages, includes all kinds of insanely detailed information that you almost certainly don't need to know for the exam. Just learning how to do all the web-based problems will take you long enough. Alice-the-Actuary has kindly curated the source text so the wiki covers everything that's likely to appear on the exam. That includes the overall calculation of the RBC ratio, the various regulator action levels, and details on calculating the individual risk charges R1, R2, R3, R4, R5. Examples and practice for the R0 and Rcat calculation are provided in the wiki and are easy compared to the others. Yay!

Estimated Study Time: 1 week (not including subsequent review time) #BondSizeFactorNote

| Source Readings: BattleActs includes all material from past exams in at least 1 of the elements of the system: wiki articles, BattleCards, BattleTables. It also covers significant material that has not appeared on past exams but that I've judged to be important. Still, it's a good idea to spend a portion of your time reviewing the source readings. You may have a different opinion on what's important and what you can skip. You cannot read all 2,500 pages in depth, but BattleActs give you the necessary background knowledge so that the time you do spend on the source readings will be much more efficient. For a little more on this click on Using the Source Material. |

BattleTable

Based on past exams and Alice's expert judgment, the main things you need to know (in rough order of importance) are:

- calculating RBC charges R0,1,2,3,4,5,cat, operational risk & RBC-ratio

- identifying action level based on RBC ratio & subsequent regulator/company actions

- strategies for reducing RBC charges

- comparison to IRIS ratios

The RBC questions from 2012 appear to be at least partially outdated and are highlighted in tan. Portions of questions from 2013-2019 may also be partially outdated as explained in the Study Tips' section.

| Questions held out from Fall 2019 exam: #5, 18, 19. (Skip these now to have a fresh exam to practice on later. For links to these questions, see Exam Summaries.) |

reference part (a) part (b) part (c) part (d) E (2019.Spring #13) identify:

- RBC action level + actionsmateriality standard:

- propose a standardcalculate:

- R4E (2019.Spring #15) calculate:

- R5 7,8E (2018.Fall #18) calculate:

- RBC ratioidentify:

- RBC action level + actionsNAIC.IRIS E (2018.Spring #18) calculate:

- change in RBC charge 7rapid premium growth:

- impact on RBCE (2017.Fall #17) calculate:

- RBC ratio aidentify:

- RBC action level + actionsE (2017.Fall #18) financial health:

- use of RBC ratios9R0 RBC charge:

- difference vs R1,2,3,4,5RBC vs IRIS:

- similarity & differenceE (2017.Spring #19) calculate:

- total RBC1calculate:

- RBC RAL2RAL actions:

- insurer & regulatorE (2016.Fall #16) RBC risk categories:

- identify 2 categoriesRBC purpose:

- for regulatorRBC formula: advantages/disads9 E (2016.Fall #17) calculate:

- RBC ratioidentify:

- RBC action levelidentify:

- RBC actionsE (2016.Spring #26) see Freihaut.Reins calculate:

- R3, R4 5see Freihaut.Reins E (2015.Fall #17) calculate:

- R1calculate:

- R2reducing R1:

- identify 2 waysE (2015.Fall #19) calculate:

- ACL & regulator actionOdomirok.25-Solv2 Odomirok.25-Solv2 E (2015.Spring #19) components of RBC:

- describeidentifying insolvency:

- aspects of RBCinterpret RBC ratio:

- ratio = 310%internal capital model:

- concerns (vs RBC)E (2015.Spring #25) see Freihaut.Reins see Freihaut.Reins calculate:

- RBC ratio (R3, R4, R5) 6E (2014.Fall #18) calculate:

- R5, total RBC 3improving RBC ratio:

- reserving practiceslimitations of RBC: 3a

- for identifying impairmentE (2014.Spring #20) calculate:

- R3calculate:

- RBCaction level:

- identify action 4E (2013.Fall #21) RBC risk categories:

- identify 2 categoriescalculate:

- RBC ratioaction level:

- identifyaction:

- describeE (2012.Fall #14) see Odomirok.8-9-IS reduce RBC asset risk:

- investment changesE (2012.Fall #20) calculate:

- R5see NAIC.IRIS RBC vs IRIS:

- treatment of premiumE (2012.Fall #24) solvency-based frameworks:

- create a new one! W

- 1 The examiner's report accepted 10 different answers for this calculation problem, and the first 3 answers are almost certainly wrong. It states "Other non-insurance subsidiaries" could go into R0, R1, or R2, but it can't go into R0; it can only go into R1 or R2. The first 3 sample answers put "Other non-insurance subsidiaries" into R0. The other 7 sample answers show valid combinations based on the given information. (This was a poorly exam constructed question.)

- 2 RAL stands for Regulatory Action Level

- 3 The statement of this problem contains 2 errors. See examiner's comments in examiner's report.

- 3a Interest rate risk and catastrophe risk were not taken into account by the RBC formula prior to the 2014 update of Odomirok. Both these risk are now considered in the RBC formula.

- 4 This problem has a trick related to tabular discounts for indemnity, which should not be subtracted from surplus to get total adjusted capital. See here for details.

- 5 This was a very nasty problem because they didn't give you the RBC factors. You had to memorize them which is very unreasonable. Also the 2021 update to the source text changed the test for when to split the reinsurance recoverable RBC charge between R3 and R4. That part of the examiners' report solution is outdated. (More on this in how to calculate R3 & R4.)

- 6 This is a defective question. See this forum discussion for more information.

- W Alice thinks this is a totes weird question. (You can look at it, but she thinks it isn't likely to appear again.)

- 7 There is an error in the examiner's report solution to 2018.Spring #18a. The solution uses NWP to calculate the excess growth factor. This calculation should use GWP from the Five Year Historical Exhibit. The solution for 2019.Spring #15 does indeed use GWP which is correct.

- 8 This problem requires you to calculate the company average loss and LAE ratio as a 10-year average, but the given ratios are capped at 300% for each year. Odomirok states: The company average loss and LAE ratio is a straight average over the past 10 accident years of the net loss and LAE ratios provided in Schedule P, Part 1, column 31. Loss and LAE ratios for any accident year in excess of 300% are capped at that value in consideration of anomalous, one-time results.

- 9 Part of the answer to these problems is outdated in the examiner's report because the new version of the RBC formula (for the syllabus starting 2021.Spring) now includes operational and catastrophe risk.

- a Note that this problem uses an outdated version of the RBC formula. For an updated solution, see Alice's 4th Day

Full BattleQuiz You must be logged in or this will not work.

In Plain English!

Alice's 1st Day (Intro to RBC)

| BattleActs Coffee Mug Challenge! Alice has double-checked her RBC calculations but if you find an RBC calculation error that slipped past her, let her know at info@battleacts.ca and we'll send you a BattleActs coffee mug! |

This wiki article is the "true story" of Alice's early days in her career when she was a summer intern. Alice's "days" don't necessarily correspond to your own study days. Her days are short and you can probably cover more than one of her days in one of your days.

On Alice's first day of work as an actuarial intern, her mean boss dumped a stack of financial statements on her desk and told her to find out whether the company was healthy. But before she could ask him anything, he was already down the hall issuing orders to someone else. "What have I gotten myself into?" she thought. Poor Alice had no idea what to do. Fortunately the intern in the next cubicle overheard and peeked over the cubicle wall.

- "Just calculate the RBC ratio," her new friend said. "It's all in Odomirok. The boss likes to haze interns on their first day, but I can help you. We'll tackle it together."

So Alice and Lakshmi spent the day pulling the relevant information from the financial statements and here is what Alice learned:

Formula: RBC ratio = TAC / ACL (sounds like tackle)

- TAC = Total Adjusted Capital = 31,024,000

- ACL = Authorized Control Level capital = 5,714,839

- ==> RBC ratio = 31,024,000 / 5,714,839 = 543%

Ok, so far so good, but what in the world does 543% mean? Is that good or bad? (The following table appears near the end of chapter 19 of Odomirok).

This table overlaps with Levels of Regulatory Action from Chapter 12 of the Porter reading but is not completely consistent. See this forum discussion for more details.

action levels [CRAM] RANGE insurance dept action company action Alice's action CAL

→ Company Action Level150-200% none (initially) must submit action plan within 45 days to meet RBC standards lose a vacation day RAL

→ Regulatory Action Level100-150% commissioner has the right to issue an order specifying corrective action (not mandatory) 1 must submit action plan within 45 days to meet RBC standards no bonuses ACL

→ Authorized Control Level70-100% commissioner authorized take control of company (not mandatory) none (initially) no raises, no bonuses MCL

→ Mandatory Control Level≤ 70% commissioner must rehabilitate or liquidate (mandatory) 2 none (initially) fire the CEO 😢

- 1 Commissioner action could include restricting new business.

- 2 Insurance commissioner of domiciliary state must take action

If a company's RBC ratio falls below 200%, it's better for the company to take action than for the regulator to step in. A regulator's actions would likely be much more drastic.

Question: what could be included in a company's action plan for meeting RBC standards

- explain how to raise needed capital

- explain how to reduce operations to save money

- explain how to reduce risks to lower RBC charges

The RBC ratio of 543% for Alice's company is well above the CAL threshold, so it looks like the company is doing really well. (Note that the Bright Line Indicator Test from the SAO material should now make more sense.) Anyway, what a great first day of work for Alice. Time to relax.

The RBC test is comprehensive but it doesn't account for every type of insurance company risk. The text states that it doesn't cover risks associated with business plans & strategy, management, internal controls, systems, reserve adequacy, or ability to access capital. (It struck me that internal controls should be covered by operational risk, so I'm not sure why the text says risks due to internal controls are not included in the RBC framework.)

Alice's 2nd Day (Trend Test & Risk Categories)

Over morning coffee, Lakshmi pointed out an omission from the above "action table" that Alice learned about yesterday. If the RBC ratio is above 200% but below 300%, the company is still not in the clear. They would still have to perform the trend test. Let COR denote Combined Operating Ratio:

Trend Test: If a company's RBC ratio is in the 200-300% range and also has a COR > 120% THEN they are subject to the CAL action from the action table.

- Reminder: The COR (Combined Operating Ratio) is the sum of:

- Loss & LAE ratio = (CY net incurred loss & LAE) / NEP

- Expense ratio = [ (other U/W expenses) + (aggregate write-ins for underwriting deductions) ] / NWP

- Dividend ratio = (policyholder dividends) / NEP

- Recall that COR does not include investment income. And next time you see your CEO in the break room, you can tell him or her to get the LED out.

Anyway, Alice's new company is well above the 300% threshold so she was ready to report back to her boss that the company is in great shape, but Lakshmi stopped her.

- "Not so fast," Lakshmi said. "The RBC ratio is only 1 metric. For example, what about the IRIS ratios? It's like if you had 98% in calculus on your report card but were failing physics, English, and history. It isn't likely, but when you report back to the boss, you should qualify your conclusion on the health of the company if the only thing you calculated was the RBC ratio."

You can review NAIC.IRIS for the IRIS ratios, but getting back to the RBC ratio, Alice needs to make sure she understands exactly how the 543% value was calculated. It's a long calculation that involves several different risk components. The charge for each component represents the amount of capital required to support that particular risk. (Each component has its own calculation but we'll come back to that later.)

2019 Edition: The description of R0 is different. New risk categories Rcat and Operational Risk were added.

|

risk category risk component

[partial hint: S-FEC]notation risk charge

for this company---- Subsidiary Insurance Companies

and Miscellaneous Other AmountsR0 0 asset risk Fixed income risk R1 553,398 asset risk Equity risk R2 4,303,948 asset risk Credit risk R3 310,060 U/W risk reserve risk R4 9,561,305 U/W risk NWP risk R5 3,574,411 catastrophe catastrophe risk Rcat 130,654 operational operational risk * 332,903

- * Operational Risk is added as a final step in the calculation after applying the covariance adjustment between other risk types, and does not have a corresponding "R" indicator

You might think you'd sum these charges to find the total required capital, but that isn't how it works. Rather than a simple sum, these risk charges are aggregated using this formula:

Formula: RBC Capital Required after covariance & before operational risk = R0 + sqrt(R12 + R22 + R32 + R42 + R52 + Rcat2)

This works out to 11,096,774.

The operational risk is then easy to calculate because the basic charge is 3% of the pre-operational risk RBC total. Operational risk considers the risk of financial loss resulting from operational events that have not already been reflected in existing risk charges including: [Hint: L-PIPE, as in Lead PIPE. It was Alice with the lead pipe in the break room. Don't ever eat the last donut if Alice is around. 😀

- Legal risk

- –

- Personnel risk (in case you hired a dumb-ass intern)

- Inadequacy or failure of internal systems

- Procedural risk (and/or risk of failure of internal controls)

- External risk (due to external events)

It does not include reputational risk arising from strategic decisions. Note also that this basic 3% charge can be adjusted downward in certain circumstances. According to the source text:

- The operational risk charge is further reduced by the sum of offset amounts reported by directly owned life insurance company subsidiaries that prepare and file the Life RBC calculation, adjusted for the percentage of ownership in the directly owned life insurance company subsidiaries (but not to produce a charge that is less than zero).

These offset amounts would have to be provided. Anyway, the final total RBC according to the formula below is 11,429,677 without considering offsets to the basic 3% operational risk charge.

Formula: RBC Capital Required after covariance & after operational risk = R0 + sqrt(R12 + R22 + R32 + R42 + R52 + Rcat2) + (operational risk)

The part of the formula with the square root is called the covariance adjustment. (Alice's Canadian cousin told her that in Canada this is called the diversification credit. Risk is reduced by spreading or diversifying the risk over multiple independent categories.)

Pop Quiz! :-o

- Question: Is the covariance adjustment less than, greater than, or equal to the simple sum R1 + R2 + R3 + R4 + R5 + Rcat.

- Answer: The covariance adjustment is less than the simple sum. (Try testing this with some simple numbers. It's a version the triangle inequality you may be familiar with from calculus.)

Question 1: what is the reason for the covariance adjustment

- The reason is that risks R1 through R5 and Rcat are assumed to be independent. It's unlikely that all these risks would reach their maximum value at the same time. The covariance adjustment reduces the required capital to reflect this assumption of independence. For example, the level of equity risk (performance of stocks) is likely not related to reserve risk. A company would be unlikely to experience both very bad investment returns and very bad underwriting results at the exact same time.

Question 2: why is R0 excluded from the covariance adjustment

- Well, R0 is not independent of the other risks. In other words, R0 is correlated with the other risks. It represents the charge for an subsidiary company and investment in an subsidiary does not provide a diversification benefit.

Let's end Day 2 by applying the RBC Capital Required formula after operational risk:

- RBC Capital Required = 11,429,677 (Note that table 97 in the source text seems to have the wrong total.)

Anyway, we can now calculate the denominator for the RBC ratio:

RBC denominator: ACL capital = 50% x (RBC Capital Required)

So ACL Capital = 5,714,839 (See Alice's 1st Day.) You might also want to take a quick look at part (b) of:

- E (2017.Fall #18)

Do the mini BattleQuiz then take a break.

mini BattleQuiz 1 You must be logged in or this will not work.

Alice's 3rd Day (Ranking of Risk Charges)

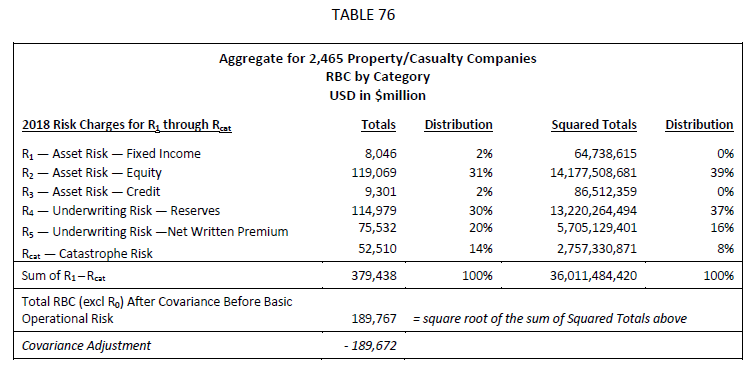

Alice arrived early today so I prepared a special pop quiz she could do while eating her morning bear claw. It's easy but you'll need the aggregate industry RBC risk charges for each category:

Pop Quiz! :-o

- Question: Based on industry totals, rank the risk charges R1 through R5 according to their relative magnitude. (You can find this information on page 244 of Odomirok)

- Answer: memory trick!

risk relative magnitude R2 asset risk - equity 31% R4 U/W risk - reserves 30% R5 U/W risk - NWP 20% Rcat catastrophe 14% R3 asset risk - credit 2% R1 asset risk - fixed income 2%

- Of course, you should also be able to explain why these rankings are the way they are. Let's start at the bottom and work up.

- asset risk - fixed income: Although fixed-income investments can have risks (for example, inflation risk) they are generally considered very safe so their RBC charge is very close to 0. An example of a fixed income investment is a government bond. Insurance companies generally have over half of their investments in this category.

- asset risk - credit: Aside from slow-paying customers, a significant portion of credit risk comes from reinsurance, but this can be at least partly controlled with sensible reinsurance arrangements.

- Now let's consider the "high-value" categories:

- catastrophe risk: Catastrophe risk is now separated from U/W risk and consists of 2 items: earthquake and hurricane risk. Hurricanes are an increasingly significant source of risk for insurers, but I'm not sure if climate change affects plate tectonics and earthquakes very much. :-)

- U/W risk - NWP: The total U/W risk, which is the risk associated with writing policies, is the most significant contributor of risk for an insurer. The total U/W risk accounts for 30% + 20% = 50% of the total. Also, the biggest component of liabilities on the balance sheet is the reserves. The intuitive reason the NWP portion of the UW risk is smaller than the reserve portion is that NWP risk is related to the unexpired portion of written policies. So if we're dealing with annual terms, the unexpired portion will be less than 1 year. Compare this to the reserves for claims that have actually been incurred: These incurred claims may span many accident years, so the risk (and associated charges) should be greater.

- U/W risk - reserves: This is the business of insurance companies and reserves is the biggest liability item on the balance sheet. Insurers have the expertise (actuaries!) to take on significant risk in this category and manage it for the mutual benefit of both the insurer and society.

- asset risk - equity: The calculation of asset risk depends on risk factors associated with different types of equity risks. We'll cover this in detail further down, but you should note that equity risk (stocks, for example) is much greater than the risk from fixed income investment (government bonds, for example)

- Just for fun, go back to the example from Alice's 2nd day and calculate how the percentages there compare to the table above. The total, without operational risk, is 18,433,776. (Answer: For R1 to R5 and Rcat the percentages are: 3%, 23%, 2%, 52%, 19%, 1%. For that example, R4 has the highest RBC charge and equity risk was a distant second. Alice's company must have either few or less risky equities in their investment portfolio.)

Alice's 4th Day (An Exam Problem.)

Today we're going to cover a calculation problem similar to the following exam problem. Note that this problem uses an outdated version of the RBC formula. For the purposes of this problem, assume Rcat = 0 and that the operational risk factor is 0% rather than 3%.

- E (2017.Fall #17)

It's a very easy problem and I'm surprised people didn't ace it. (According to the examiner's report, exam-takers made a lot of different kinds of mistakes.)

Pop Quiz A! :-o

- Given:

description scenario 1 scenario 2 scenario 3 company net loss & LAE ratio 85% 85% 85% company expense ratio 35% 35% 35% policyholder dividend ratio 10% 10% 10% Total Adjusted Capital 14,000 8,000 12,000 R0 charge 10 20 50 R1 charge 700 200 400 R2 charge 11,700 3,600 3,900 R3 charge 900 200 400 R4 charge 12,100 3,000 4,200 R5 charge 7,800 2,100 3,100 Rcat charge 5,400 1,600 2,200

- For each scenario, find:

- RBC ratio

- RBC action or control level

- appropriate regulator & company action.

- For each scenario, find:

Pop Quiz A Answers :-D

- Recall:

- RBC ratio = TAC / ACL (sounds like tackle)

- ACL capital = 50% x (RBC Capital Required)

- RBC Capital Required = 1.03 x [ R0 + sqrt(R12 + R22 + R32 + R42 + R52 + Rcat2) ]

- (The factor of 1.03 accounts for operational risk.)

- Recall:

- Scenario 1:

- RBC Capital Required = 19,946

- ACL capital = 9,973

- RBC ratio = 14,000 / 9,973 = 140% (first mug-winner: GLC!)

- Scenario 1:

- ==> action or control level: RAL (Regulator Action Level)

- ==> regulator action: commissioner has the right to issue an order specifying corrective action (not mandatory)

- ==> company action: must submit action plan within 45 days describing how to meet RBC standards (to commissioner of domiciliary state explaining how to increase capital or decrease risk)

- Scenario 2:

- RBC Capital Required = 5,568

- ACL capital = 2,784

- RBC ratio = 8,000 / 2,784 = 287%

- Scenario 2:

- ==> action/control level: depends on results of trend test because RBC ratio is in the 200-300% range

- COR = 85% + 35% + 10% = 130% > 120% ==> action level is CAL (Company Action Level)

- ==> regulator action: none (initially)

- ==> company action: must submit action plan within 45 days to meet RBC standards (to commissioner of domiciliary state explaining how to increase capital or decrease risk)

- ==> action/control level: depends on results of trend test because RBC ratio is in the 200-300% range

- Scenario 3:

- RBC Capital Required = 7,159

- ACL capital = 3,580

- RBC ratio = 12,000 / 3,580 = 335%

- Scenario 3:

- ==> action or control level: none (trend test not required because RBC ratio > 300%)

- ==> regulator action: none

- ==> company action: none

Trick: In the above problems, I gave you the value of TAC, but sometimes you have to calculate TAC using the formula: [Hint: no tabular, no medical

- TAC = PHS - (non-tabular discount) - (tabular discounts on medical reserves)

- That seems easy enough, but keep in mind that tabular discounts can be for medical or indemnity, and the indemnity portion is not subtracted. You had to know this to correctly solve:

- E (2014.Spring #20)

- The question provided the tabular discount for indemnity and the examiner's report listed as a common mistake subtracting this indemnity discount amount. So just keep that in mind.

Tip: For the practice template in the mini BattleQuiz, I sometimes like to just keep pressing the New and Cheat buttons without actually doing the calculation. I find that seeing the answer immediately helps build my intuition on how the RBC ratio corresponds to the action level (without having to stop and do the whole calculation every time.)

mini BattleQuiz 2 You must be logged in or this will not work.

Alice's 5th Day (R0 and Another Exam Problem)

We covered lots of useful information above about RBC and how to do basic calculations, but we did it in a different order from Odomirok. Let's now take a step back and look at how Odomirok organized the RBC chapter. In the problems we've already done, you were directly given R0 thru R5 and Rcat. Now you have to learn how to calculate these charges directly from financial statement information.

page topic comment 236 Overview covered above 240 RBC Formula covered above 244 R0 detailed calculation: investments in affiliates (common stock, preferred stock, alien insurers, off B/S items) 249 R1 detailed calculation: bond size, asset concentration 260 R2 detailed calculation: asset concentration 265 R3 detailed calculation: reinsurance recoverable allocation 268 R4 detailed calculation: excessive premium growth, reinsurance recoverable allocation, loss-sensitive discount, loss concentration 283 R5 detailed calculation: excessive premium growth, loss-sensitive discount, premium concentration 289 Rcat detailed calculation: 293 operational risk detailed calculation: 294 RBC Model Act covered above

As a start, let's look at an old exam problem. I didn't like how the examiner's report explained the solution, so I solved it myself in a way that made more sense to me. You can see what I did in the link below. You could have almost figured it out from what we've already covered, plus a little bit of common sense. Note: This exam problem is actually outdated because it's based on an earlier version of the RBC calculation that did not include catastrophe risk or operational risk. It's still valuable to look at however if you assume that cat risk and operational risk are both 0.

Now, here are a couple of similar practice problems but with different numbers. Note that you have to assume Rcat and operational risk are 0.

And finally, here is the link to the actual exam problem and answer. They accepted 10 different answers because they didn't provide enough information in the statement of the problem. (You had to make certain assumptions.) Anyway, it might be instructive to take a quick look at some of the alternate answers. Don't spend too long on that though.

- E (2017.Spring #19)

A quick primer on calculating R0: The most recent version of Odomirok added details regarding the R0 calculation. This is discussed below.

The R0 charge considers the risks associated with investments in subsidiary insurance companies as well as miscellaneous off-balance sheet and other items. Specifically, there are separate RBC charges for:

- common stocks in the subsidiary

- preferred stocks in the subsidiary

- investments in alien insurance company affiliates

- off-balance sheet or other items

Subsidiary and affiliated insurance companies are only considered within R0 if they are U.S. domiciled entities subject to RBC, or if they are alien insurers (foreign to the U.S.).

There are 5 formulas you need to memorize. The charge for common stock depends on the accounting method the reporting entity uses to report the investment.

R0 (common stocks) using equity method = min[ affiliate RBC x (ownership% of common stock) , value of common stock as recorded by reporting entity ] R0 (common stocks) using market method = min[ affiliate RBC x (ownership% of common stock) , (statutory surplus of affiliate) x (ownership% of common stock) ]

- Note: The R0 formula for the market method is potentially more complicated than what's written above, but I think it has zero chance of being asked. If you'd like to see the full formula, see Expanded R0 Formula for Market Method.

The formulas for the other items are:

R0 (preferred stocks) 1 = min[ (affiliate RBC - total value of common stock) x (ownership% of preferred stock) , value of preferred stock as recorded by reporting entity ] R0 (alien insurance affiliate) = 0.5 x (carrying value of company's interest in affiliate) R0 (off-balance/sheet items) = 1.0% x (value of each off-balance sheet item)

- 1 This charge cannot be less than 0. If the formula gives a negative value, just set it = 0 instead.

In the formula for preferred stocks, the quantity (affiliate RBC - total value of common stock) is referred to a the subsidiary's excess RBC.

In the formula for off-balance sheet items, the 1.0% risk factor is almost always the appropriate factor. memory trick!) This charge would be applied to the following:

- non-controlled assets

- guarantees for the benefit of affiliates

- contingent liabilities

- DTAs (Deferred Tax Assets)

There have not been any published exam questions where you had to calculate R0. If an R0 calculation does appear on the exam it will probably be fairly simple. Here are a few examples:

Example 1: An insurer has 40% ownership of common stock in an insurance subsidiary that has 100,000 in common stock. The total RBC charge for the affiliate is 70,000. The affiliate's statutory surplus is 60,000. The reporting entity uses the equity method of accounting.

- → R0 for reporting entity = min[ 70,000 x 40% , 100,000 x 40% ] = 28,000

Example 2: An insurer has 40% ownership of common stock in an insurance subsidiary that has 100,000 in common stock. The total RBC charge for the affiliate is 70,000. The affiliate's statutory surplus is 60,000. The reporting entity does not use the equity method of accounting. (It uses the market method. For the purposes of this simple example, ignore the "B" component of the charge. See Expanded R0 Formula for Market Method for a description of B.)

- → R0 for reporting entity = min[ 70,000 x 40% , 60,000 x 40% ] = 24,000

Example 3: An insurer owns 25,000 of common stock in an insurance subsidiary that has 100,000 in common stock. The total RBC charge for the affiliate is 70,000. The reporting entity uses the equity method of accounting.

- → R0 for reporting entity = min[ 70,000 x 25% , 100,000 x 25% ] = 17,500

Example 4: An insurer has 50% ownership of preferred stock in an insurance subsidiary that has 100,000 in preferred stock. The total RBC charge for the affiliate is 70,000 and the affiliate owns 40,000 of common stock. The accounting method is not relevant when dealing with preferred stocks.

- → R0 for reporting entity = min[ (70,000 - 40,000) x 50% , 100,000 x 50% ] = 15,000 ← if < 0, just set = 0

Example 5: Annual Statement carrying value of the company’s interest in the alien insurance affiliate is 120,000. ← BA mug winner: VP!

- → R0 for reporting entity = 0.5 x 120,000 = 60,000

Example 6: An insurer records a total carrying value of 200,000 for balance sheet assets over which it does not have exclusive control.

- → R0 for reporting entity = 1.0% x 200,000 =

3.141592652,000 ← BA mug winner: DB!

We will cover the detailed calculations for R1 through R5 in Alice's second week on the job.

mini BattleQuiz 3 You must be logged in or this will not work.

Week 2: Day 1 (R1)

| BattleActs Coffee Mug Challenge! Alice has double-checked her RBC calculations but if you find an RBC calculation error that slipped past her, let her know at info@battleacts.ca and we'll send you a BattleActs coffee mug! |

Now we're getting down into the weeds of the RBC calculations. There is a lot of detail here. You must practice, practice, practice. This section on R1 is quite long, but the subsequent section on R2 is much shorter because it's similar to R1.

You can click to see a summary table for R1 and R2. It might be an idea to take a quick look, but it won't mean much until you've covered the R1 and R2 details.

General

Recall the subsidiary risk R0 and the 3 asset risk categories R1, R2, R3 with the hint: S-FEC

- Subsidiary risk (this is the R0 charge)

- Fixed income risk (this is the R1 charge)

- Equity risk (this is the R2 charge)

- Credit risk (this is the R3 charge)

In particular, the R1 RBC charge covers interest rate risk and default risk for fixed income investments in the following 5 categories:

- Bonds

- Off-balance sheet collateral and Schedule DL, Part 1, Assets

- Other long term assets (includes mortgage loans, low income housing tax credits, working capital finance investments)

- Miscellaneous assets (includes cash, cash equivalents, other short-term investments, nonadmitted collateral loans)

- Replication (synthetic asset) transactions and mandatorily convertible securities

Note that the prior version of the RBC formula listed 10 categories including a category for holding companies that is no longer on this list. The text examples were not affected however and the actual calculation of the R1 charge did not change. (Since the R1 calculation for holding companies seems to have been removed, calculating R1 should actually be easier than before.)

In any case, I don't think you have to memorize the above list. If you get an R1 or R2 problem on the exam, I would just assume that all the investments given in the problem are subject to the basic charge. That is, as long as you use only fixed income investments for R1 and equity investments for R2.

The largest contributor to the R1 charge is unaffiliated bonds. Note also that the 'Bond Size Charge' and 'Asset Concentration Charge' together account for a significant portion of R1. Those components are explained further down.

Today we're covering the detailed calculations for R1. We'll be basing the discussion on the exam problem below from 2015.Fall. It gives you financial statement info on stocks and bonds then asks you to calculate R1 and R2.

- E (2015.Fall #17)

Anyway, let's get back to R1. Consider a simplified version of the exam problem:

quantity notation value description basic R1 charge -- 406 this is the basic RBC charge for fixed income investments owned by the insurer bond size charge BSC 609 an extra charge reflecting the level of diversification of the unaffiliated bond portfolio asset concentration charge ACC 379 reflects increased risk of large concentrations of bonds

(doubles the RBC charge for the 10 largest issuers)

Given the information in the above format, calculating R1 is trivial:

Formula: R1 = basic charge + BSC + ACC

The answer is:

- R1 = 406 + 609 + 379 = 1,394.

But in the exam problem, you are not given these quantities directly - you have to calculate them. If BSF stands for Bond Size Factor then here's what you need:

quantity formula basic = Σ [ (asset values subject to basic charge) x (RBC factor) ] BSC = BSF x (total R1 charges for bonds subject to BSF) ACC = Σ [ (asset values subject to ACC for TOP 10 issuers) x (RBC factor) ]

We'll cover how to calculate each of these 3 components in the next few subsections. We're going to use portions of the example in Odomirok to demonstrate the calculation and then come back to the exam problem at the end of this section.

Basic R1 RBC charge

This part of the calculation is very simple. You just multiply the amount held in each fixed investment category by the RBC factor.

Example:

item amount RBC factor RBC charge = (amount) x (RBC factor) cash & equivalents 154,000 0.0030 462 mortgage bonds 245,000 0.0500 12,250 U.S. government bonds 6,395,684 0.0000 0 Class 02 unaffiliated bonds 4,987,460 0.0100 49,875

And assuming these are all the fixed income investments the company has, the basic R1 RBC charge is just the sum of the last column: 62,587

Notes on the RBC charge factor:

- ==> depends on the category of investment or class of bond

- ==> investments are classified according to their credit-worthiness (see also bonds)

- ==> the exam problem considers only class 02 bonds, which are high credit quality so the RBC charge is relatively low

Bond Size Charge (BSC)

To calculate the bond size charge BSC, you first need to calculate BSF (Bond Size Factor). To do this, you need the following table from Odomirok:

# bond issuers

(1)weights

(2)weighted # of issuers

(3) = (2) x (1)first 50 2.5 next 50 1.3 next 300 1.0 > 400 0.9 Total

Example: If there were 325 issuers then you would fill in the above table as follows but counting only issuers of bonds subject to the BSF.

# bond issuers

(1)weights

(2)weighted # of issuers

(3) = (2) x (1)first 50 50 2.5 125 next 50 50 1.3 65 next 300 225 1.0 225 > 400 0 0.9 0 Total 325 415

- Then BSF = 415 / 325 - 1 = 0.277.

Pop Quiz B! :-o

- Calculate the BSF (Bond Size Factor) for the following total # of bond issuers: Click for Answer

- (a) 10

- (b) 85

- (c) 120

- (d) 575

Notes on BSF:

- ==> only the following bond classes are subject to BSF

- class 01 → 06 unaffiliated bonds

- (exclude U.S. government bonds) (shout-out to DS!)

- ==> BSF decreases as bond count increases

TYPO in new edition of source text: The current Odomirok source text states the following: • The bond size factor is calibrated such that the break-even point where the factor equals 1.0 is set at 1,300 bonds.

• This should be: equals 0.0.

CHANGE in new edition of source text:• Portfolios containing 1,300 or more bonds will receive a discount to their RBC charge for bonds.

• (In the prior version of Odomirok, portfolios containing 1,300 or more bonds did not receive a charge or a discount.)See also this forum thread. (shout-out to kulotus, BA MUG winner!)

Warning: The source text states that unaffiliated classes 02-06 plus non-U.S. government bonds in class 01 are subject to the BSF. But then their example includes class 01 unaffiliated bonds. I will assume that BSF is applied to unaffiliated bonds class 01-06 and non-U.S. government bonds.

In the text example, # of bond issuers = 120, which is part (c) above and so BSF = 0.750. The final part of the BSC calculation is to multiply BSF by the R1 bond charges that are subject to the BSF. In the text example, this value is 247,319. (This is highlighted in the next pop quiz and also explained further down when we look at the full R1 exhibit.)

- BSC = 0.750 x 247,319 = 185,490.

Pop Quiz C! :-o

- Question: Sometimes you aren't given a single value for the # of bond issuers. You have to calculate that yourself. Using the data below, calculate:

- (a) basic R1 charge

- (b) BSF

- (c) BSC

- Hint: To calculate BSC, you don't multiply BSF by bond values. Rather, you multiply BSF by the R1 charges for bonds that are subject to the BSF. Click for Answer

fixed income investment amount RBC factor # bond issuers U.S. government bonds 8,000 0.0000 200 class 01 unaffiliated bonds 1,000 0.0030 70 class 02 unaffiliated bonds 2,000 0.0100 50 class 06 unaffiliated bonds 3,000 0.3000 90 collateral loans 5,000 0.0500 100 mortgage bonds 3,500 0.0500 100

Asset Concentration Charge (ACC)

Warning: Odomirok uses a totally different example to demonstrate the ACC calculation versus the comprehensive R1 calculation. (There is a link to the example exhibit further down.) For this section, we'll use the data from their example, but the practice problems Alice created will give you 1 set of numbers for the whole R1 calculation. You're welcome. :-)

Note from the RBC charge summary table that both R1 (fixed income investment risk) and R2 (equity investment risk) have an asset concentration charge. Now, I'd like to cover the R1 calculation here and save the R2 calculation for the next section, but you can't completely separate R1 and R2. Why the heck not???!!! Alice will explain below.

The first thing you have to know is which fixed income investments are subject to the ACC: (items in green font are used in Odomirok's example)

- unaffiliated bonds in classes 02 through 05

- collateral loans

- mortgage loans

This list has 3 items for the purposes of sorting (see below) but each bond class 02 through 05 subsequently receives its own RBC factor.

The first thing you have to know is which equity investments are subject to the ACC: (items in green font are used in Odomirok's example)

- unaffiliated preferred stocks and hybrid securities in classes 02 through 05

- unaffiliated common stock

- investment in real estate

- encumbrances on invested real estate

- schedule BA assets (excluding collateral loans)

- receivable for securities

- aggregate write-ins for invested assets

- derivatives

This list has 8 items for the purposes of sorting (see below) but each stock class 02 through 05 subsequently receives its own RBC factor. The example from Odomirok, whose link is provided below, uses only the investments in green font from the 2 lists above. (And the 2015 exam problem is an even more simplified version of the text example.)

Why ACC for R1 & R2 can't be completely separated:

- Note how in the table in the text they sum the fixed & equity investments for each bond issuer then rank the issuers from highest to lowest.

- For this ranking, the fixed investments are not separated from the equity investments – they are all mixed together.

- This is why you cannot completely separate the ACC calculations for R1 & R2.

If I were going to write a step-by-step procedure for myself on how to calculate ACC, this is how I would do it:

- step 1: gather all fixed income investments and equity investments that are subject to the ACC (see above lists)

- step 2: sort the list from highest to lowest

- step 3: truncate this list and keep only the top 10 rows of this table

Then these last 2 steps are done separately for R1 & R2.

- step 4: sum the TOP 10 results in each separate category (classes 02 through 05 are treated separately at this step)

- step 5: multiply each sum from step 4 by the appropriate RBC factor

Note that for step 4 for the text example, Odomirok assumes all bonds are class 02 and all stocks are class 03. (shout-out to AB!) You can see this in the text table.

ACC Concept: The asset concentration charge basically just doubles the RBC charge for the 10 largest issuers.

| Pop Quiz D! :-o |

- For the example in Odomirok, verify that R1 = 95 and R2 = 218. (Note that the grand ACC total in text table is listed as 312. But 95 + 218 = 313. Hey Odomirok, do arithmetic much? ← that's an Alice joke.)

| Question: what is an ACF or Asset Concentration Factor |

- Th ACF was used in the text example from above:

- ACF = weighted average of RBC factors for assets subject to the concentration charge

- Therefore, if someone tells you the ACF, you can calculate the ACC very easily with the formula below:

- ACC = ACF x (total value of assets subject to the concentration charge)

You should quickly double-check the R1 ACF value of 0.020 and the R2 ACF value of 0.074 from the text table. (shout-out to mec06e!)

- → I found all this information hard to keep straight in my head. I had to do a lot of practice problems before I understood clearly how all the different pieces fit together.

Full R1 Examples

So you see that calculating R1 can get messy really quickly. It isn't that the concept is hard. You just have to remember the 3 components.

Formula: R1 = basic charge + BSC + ACC

And here is a nice presentation of the full R1 example from Odomirok:

- Odomirok - full R1 example (table 88) ← doesn't show details for asset concentration charge

- Odomirok - full R1 example - combines 2 text examples ← my version shows details for the asset concentration charge example from table 86 & 87

Finally, here is my solution to the exam problem referenced at the top of the R1 section. Note that this exam problem is very simplified because there is only 1 category of fixed income investments (unaffiliated bonds) and then there is only 1 class of unaffiliated bonds (class 2.)

And here are a couple of similar practice problems but with different numbers: (shout-out to AS!)

And since Alice is evil, she has created 4 more full R1 practice problems to ruin your day: :-)

Just to summarize, here are references to the components of the Odomirok R1 example:

- current edition tables 78-79: calculation of the BSF (Bond Size Factor)

- current edition tables 80-81: calculation of ACC (Asset Concentration Charge) for R1 and R2 for a company with multiple classes of fixed income and equity assets

- current edition table 82: calculation of total R1 for a company that has multiple classes of fixed income and equity assets

Week 2: Day 2 (R2)

General

Recall the subsidiary risk R0 and the 3 asset risk categories R1, R2, R3 with the hint: S-FEC

- Subsidiary risk (this is the R0 charge)

- Fixed income risk (this is the R1 charge)

- Equity risk (this is the R2 charge)

- Credit risk (this is the R3 charge)

R2 includes the charge for risk associated with equity investments in the following categories:

- Affiliated investments

- Unaffiliated stocks ← major contributor to R2 charge

- Real estate

- Schedule BA assets ← major contributor to R2 charge

- Miscellaneous assets, including receivables for securities, aggregate write-ins for invested assets and derivatives

- Replication (synthetic asset) transactions and mandatory convertible securities

This list is slightly different from the previous version of Odomirok but the text examples were not affected and the mechanics of calculating the R2 charge did not change.

The asset concentration charge is also a major contributor to the R2 charge. This calculation is similar to the R1 calculation except easier because there's no BSF term (Bond Size Factor.) The only modification to the basic charge is the ACC (Asset Concentration Charge.)

If you're given basic charge = 1,365 (basic R2 charge) and ACC = 1,335 then even Ian-the-Intern can calculate R2 correctly. :-)

Formula: R2 = basic charge + ACC

The answer is:

- R2 = 1,365 + 1,335 = 2,700.

Of course in the exam problem, you're not given these quantities directly - you have to calculate them. But this too is easy because it's very similar to the calculation for R1. Actually the formulas are the same – they just apply to equity assets instead of fixed income assets.

quantity formula basic charge = Σ [ (asset values subject to basic charge) x (RBC factor) ] ACC = Σ [ (asset values subject to ACC for TOP 10 issuers) x (RBC factor) ]

Now, calculating R2 can still get messy for the same reasons that R1 gets messy. But it isn't conceptually difficult. One slight complication however is an equity asset under the category of affiliated investments for holding companies. Its RBC calculation is a little different. You don't multiply its value by the RBC factor. Rather you multiply the RBC factor of 0.225 by the holding company value in excess of the carrying value for indirectly owned insurance affiliates calculated in R0. There is an example calculation on the wiki page RBC for Holding Companies.

Pop Quiz E! :-o

- Go back to the practice problems from the previous section and calculate R2. (the 2 practice problems like 2015.Fall #17)

Pop Quiz E Answers! :-D

- practice 01: R2 = (basic charge) + ACC = (52,600 x 0.15) + (52,600 - 300 - 0) x 0.15 = 15,735 ← shout-out to meowyadoin! Note from Alice: I'm purrin fine!!

- practice 02: R2 = (basic charge) + ACC = (51,100 x 0.15) + (51,100 - 600 - 500) x 0.15 = 15,165 ← shout-out to meowyadoin & nraoof & TD!

Now that we've covered R1 and R2, there's a comment I made in Week 2: Day 1 about allocation of the ACC (Asset Concentration Charge) that should now make more sense. Recall that the exam problem we looked at had 10 different sample answers in the examiner's report. One source of ambiguity was that they didn't tell how to allocate ACC between R1 and R2. You now know that the ACC is calculated separately for R1 and R2, but the exam problem only provided the total ACC. To properly solve the problem, you had to know how much went into R1 and how much went into R2. Since they didn't tell you, you had to make an assumption:

- The examiners accepted any allocation of ACC between R1 and R2.

The simplest thing to do is put it all either in R1 or R2, and I opted to put it all in R2.

(shout-out to KB!)

Here's 1 final follow-up question on the ACC.

Question: in general, which assets are not subject to the ACC (Asset Concentration FactorCharge) ← shout-out to PU!

- assets deemed to be of low risk (like class 01 unaffiliated bonds or preferred stock)

- assets that have already received the maximum charge of 0.3000 (like class 06 unaffiliated bonds)

Summary for R1 & R2

- Ian-the-Intern kept getting confused when Alice asked him to calculate R1 & R2 so she made him a summary table that helped him keep things going straight (or gaily forward, whichever the case may be.)

(Note that if you print this, the background colors are not visible. I don't know why.)

(Update: Someone astutely pointed out in the forum that if you copy the table and paste into Excel, when you print, it will show the colors. Thanks!)

item R1 R2 formula → R1 = basic charge + BSC + ACC R2 = basic charge + ACC formula → basic charge

= Σ [ (asset values subject to basic charge) x (RBC factor) ]same formula as for R1, applies to different assets types of assets subject to basic charge fixed income assets

[1] Bonds

[2] Off-balance sheet collateral and Schedule DL, Part 1, Assets

[3] Other long term assets

[4] Miscellaneous assets (cash, cash equivalents,...)

[5] Replication transactions, mandatorily convertible securities

• see footnote 2equity assets

[1] Affiliated investments

[2] Unaffiliated stocks

[3] Real estate

[4] Schedule BA assets

[5] Miscellaneous assets

[6] Replication transactions, mandatory convertible securities

formula → BSC (Bond Size Charge)

= BSF x (total R1 charges for bonds subject to BSF)not applicable types of assets subject to BSF fixed income assets 1

- class 01-06 unaffiliated bonds

- non-U.S. government bondsnot applicable formula → ACC (Asset Concentration Charge)

= Σ [ (asset values subject to ACC for TOP 10 issuers) x (RBC factor) ]same formula as for R1, applies to different assets types of assets subject to ACC fixed income assets

- bonds (class 02-05)

- collateral loans

- mortgage loans

- working capital finance investments – NAIC 02

- low income housing tax creditsequity assets

- unaffiliated preferred stocks & hybrid securities (class 02-05)

- unaffiliated common stock

- real estate

- encumbrances on invested real estate

- schedule BA assets (excluding collateral loans)

- receivable for securities

- aggregate write-ins for invested assets

- derivatives

- 1 The source text states that unaffiliated classes 02-06 plus non-U.S. government bonds in class 01 are subject to the BSF. But then their example includes class 01 unaffiliated bonds. I will assume that BSF is applied to unaffiliated bonds class 01-06 and non-U.S. government bonds.

- 2 The 2019 edition of Odomirok has a discrepancy in the RBC factor for Schedule BA assets. In Table 81 on page 258, the factor is listed as 0.05, but on page 264 the factor is listed as 0.2. (shout-out to pb!)

Here are 2 problems that combine the calculation of R1 & R2.

And here's a quiz that covers both the R1 and R2 calculation.

mini BattleQuiz 4 You must be logged in or this will not work.

Week 2: Day 3 (R3 with intro to R4)

Recall the subsidiary risk R0 and the 3 asset risk categories R1, R2, R3 with the hint: S-FEC

- Subsidiary risk (this is the R0 charge)

- Fixed income risk (this is the R1 charge)

- Equity risk (this is the R2 charge)

- Credit risk (this is the R3 charge)

Below is a link to a problem from way back in 2014 where you have to calculate R3. It's pretty easy (aside from 1 small trick) because they explicitly tell you which financial statement amounts relate to credit risk and they give you the associated RBC factors.

Without even studying this section, you could guess that to calculate R3 you have to multiply credit-related amounts by the corresponding RBC factors. You'd probably get half the points just doing that. But to get full points, you'd have to know the trick:

- E (2014.Spring #20)

If you looked at the solution, you'll see that after multiplying the credit-related amounts by the RBC factors they made an adjustment for reinsurance. That's the trick.

R3 Trick: The RBC charge for reinsurance recoverable is split 50/50 between R3 and R4 1

- 1 Use this split only if:

- unpaid loss & LAE component of R4 > (RBC charge for non-invested assets) + ½ x (RBC charge for reinsurance recoverables) (shout-out to luohuasheng! )

- Note that R3 is always greater than the right-hand-side of this inequality since the right-hand-side contains only 2 of the 3 components of R3. The 3 components of R3 are (see Assets subject to R3): non-invested assets, reinsurance recoverables, health credit risk.

- Remember that R4 (30% of industry-wide RBC charges) should almost always be greater than R3 (2% of industry-wide RBC charges). Therefore, this inequality should virtually always be true. And in fact, the examiner's report never even checked – they just went ahead and did the 50/50 allocation. (If by some freak occurrence this inequality were false, then 100% of the charge for reinsurance recoverable would go to R3. This could happen in the case of "limited net reserves" because then R4 could be small enough relative to R3. This reserve RBC limitation exists so the company cannot diversify away a portion of its credit risk in that situation. thx PA!)

In this problem you also have to calculate R4 but it's very easy because they give you all the components. You just have to recognize them:

- basic loss reserving RBC charge: 400,000

- excessive growth charge/penalty for loss reserves: 75,000

Just add them up then throw in the 50% allocation for the reinsurance recoverable charge. (See the R3 trick above.)

We'll cover the detailed calculations for R4 and R5 in further down. They are hard problems.

Assets subject to R3

I would have said what we covered above this is very likely all you need to know about R3, but Alice reminded me about part (b) of the following rather unfair problem:

- E (2016.Spring #26) ← calculation of RBC charge for reinsurance recoverables is outdated - see the practice problem further down for the current calculation

The reason it's unfair is that you had know the RBC factors for the components of R3. In one of the previous quizzes, there was a practice template on calculating total RBC. To solve it, you had to know which of the financial statement items are subject to the R3 charge, but in that problem I gave you the factors. Let's step back for a moment and list all the possible R3 items. (Items in green relate to this exam problem.)

- 1. Non-Invested Assets:

- Investment income due and accrued (factor = 0.01)

- Amounts Receivable related to uninsured plans (0.05)

- Federal income tax recoverable (0.05) ← removed from calculation for the most recent version of the RBC formula

- Guaranty funds receivable or on deposit (0.05)

- Recoverable (parent/subs/affiliates) (0.05)

- Aggregate Write-ins for other than Invested Assets (0.05)

- 2. Reinsurance recoverable (0.1) ← for more information click to see this forum discussion

- 3. Health Credit Risk (accounts for 0% of P&C insurer risk)

Now, in (2016.Spring #26), you weren't given the actual RBC charges, you were given the financial statement amounts. To get the charges you had to multiply each by the correct RBC factor, which was not given. (The correct factors are in parentheses in the above list.) In other words, they expected you to memorize these factors. If you didn't memorize these factors, my advice would be to make up something reasonable like 0.05 (shout-out to PA!) and just use that across the board. Technically you'd get the wrong answer but it would let you complete the problem and if you did everything else correctly you would still get most of the points. (Alice thinks it was ridiculous to expect you to memorize the RBC factors. Don't get her started!)

R3 trick: The solution in the examiner's report explicitly checked the inequality for the R3 trick. I wonder if they deducted points for not checking, even if you correctly did the 50/50 allocation. They didn't mention it.

Here are a couple of practice problems on R3 that I think are self-explanatory. They aren't hard. Here's what you do:

- calculate the basic charges for non-invested assets, reinsurance recoverables, and health credit risk. You do this simply by multiplying the given amounts by the RBC factors.

- the RBC charge for reinsurance recoverables comes directly from Schedule F, Part 3, Columns (35) & (36):

- Column (35): Credit Risk on Collateralized Recoverables

- Column (36): Credit Risk on Uncollateralized Recoverables

- check the allocation of the RBC charge for reinsurance provision using the TRICK mentioned above

- then just sum the final charges for the 3 categories: non-invested assets, reinsurance recoverables, and health credit risk

Here are a few R3 practice problems.

There is a practice template for R3 in the quiz at the end of the next section.

Week 2: Day 4 (R4)

Recall that U/W risk (versus asset risk) has 2 categories:

- reserve risk (this is the R4 charge)

- NWP risk (this is the R5 charge)

Recall that R4 is a significant contributor of risk to a company. The calculations for R4 are quite involved but do not often appear on the exam. Nonetheless, Alice has created some practice problems for you and there is a practice template in the quiz at the end of the next section.

There are 4 components to the R4 charge, the first 3 of which you should probably know how to calculate. The last one, health stabilization, is not discussed in any detail in Odomirok.

- 8% of the R4 charge: reinsurance recoverables (reinsurance RBC that was part of the R3 calculation)

- 91% of the R4 charge: unpaid loss & LAE reserve

- 1% of the R4 excessive premium growth RBC

- 0% of the R4 charge: health stabilization RBC

Most of the section on R4 in Odomirok is about calculating the RBC for unpaid loss & LAE reserve. The component for excessive premium growth RBC is almost exactly the same as for R5 and is discussed in the next section.

Before charging ahead, let's take a step back:

- Remember how you did the RBC calculations for R1, R2, and R3? In each case, you had to know which financial statement amounts were subject to each charge. You use fixed income assets for R1, equity assets for R2, and credit-related items for R3.

- Then you calculated the basic charge by multiplying those amounts by the appropriate RBC factor. This RBC factor might be high or low depending on whether the asset is high-risk or low-risk.

- Then you made various adjustments to these basic charges to get the final RBC charge. For example, the bond size charge and asset concentration charge for R1.

It's the same idea for the R4 reserve component but at first it didn't look like it, at least it didn't for me. The reason was that Alice's practice problems don't provide any RBC factors.

- For the R4 reserve component, you have to calculate the RBC factor yourself. (The RBC factor is the quantity [[(C+1) x A] -1]. This is explained below and in the practice problem.)

- And there is only 1 financial statement amount that's subject to this charge, net loss & LAE reserves. (Note however that the basic R4 charge for reserves is calculated separately for each line of business.)

Company RBC%: This is the C-value in the formula [[(C+1) x A] -1].

- → The Company RBC% is derived from the corresponding Industry RBC% by applying a company-specific adjustment.

- → The adjustment factor = (company L+LAE LDF)/(industry L+LAE LDF).

- → The LDFs are calculated as the (current reserve for 9 prior AYs)/(initial reserves for those AYs). ← capped at 400%

- → A is an adjustment for investment income and A<1.

And there are then 2 further adjustments that are made to the basic R4 reserve charge:

- LSD or Loss-Sensitive Discount, which is subtracted from the basic charge

- LCF or Loss Concentration Factor, which is a multiplicative adjustment

Once you've got all that, you can add in the reinsurance recoverable RBC and the excessive growth charge. We'll just assume the health stabilization charge is 0 since it is rarely a material amount for P&C insurers. (Recall that the reinsurance recoverable RBC is usually, but not always, split evenly between R3 & R4. See the section on R3 to review the details.)

Here's an example of the R4 calculation from Odomirok. It's interesting because it also provides the annual statement locations for the various amounts that are needed for the calculation. (It's mostly Schedule P. Some of the amounts are provided by the NAIC.)

| Now you're ready to tackle a full R4 problem! |

The problem is based on a similar problem for R5 that has appeared several times on past exams. Don't freak out when you see it. If you practice it several times, it will make more sense. It just has a lot of moving parts and you have to memorize the formulas that put all the different parts together to get the final answer. There is also a practice template in the quiz at the end of the next section on R5

→ tubaguy has a good memory trick for the R4 and R5 formulas. thx tubaguy!

And now for the nightmare scenario of an infinite number of practice problems... and you cannot stop until you get them all right... :-O

mini BattleQuiz 5 You must be logged in or this will not work.

Week 2: Day 5 (R5)

Recall that U/W risk (versus asset risk) has 2 categories:

- reserve risk (this is the R4 charge)

- NWP risk (this is the R5 charge)

The calculations for R5 are complicated and unfortunately there have been exam problems that test the gory details. You can see this in the BattleTable at the top of this wiki article. The problems from 2014 and 2012 are fairly similar except for the reference to the claims-made discount in the 2012 problem. The syllabus has changed since 2012 and that problem is no longer relevant. Alice's advice is to ignore the problem from 2012. The 2014 problem covers the major details of the R5 calculation so if you know how to do it, you should be prepared for any kind of R5 question you might get on the exam.

There are 4 components to the R5 charge, but you only need to worry about the calculations for the first two.

- 99% of the R5 charge: written premium RBC

- 1% of the R5 charge: excessive premium growth RBC

- 1% of the R5 charge: health premium RBC

- 0% of the R5 charge: health stabilization RBC

Odomirok says this adds up to 100%, but the given percentages obviously add up to 101%. I know it's just rounding, but it confused poor Ian-the-Intern. They could have fixed it by keeping an extra decimal. Anyway, it's not terribly important. Maybe I'm just procrastinating because R5 is such a pain to learn.

Several comments from the R4 section above also apply to R5. You are not given the RBC factor for the NWP component – you have to calculate it. (The RBC factor for the R5 NWP component is (CxA)+U-1, and is explained in the practice problem.) And there is only 1 financial statement amount that's subject to the R5 charge, net written premium. (Note however that the basic R5 charge is calculated separately for each line of business.)

There are then 2 further adjustments that are made to the basic R5 charge: (note the similarity to R4)

- LSD or Loss-Sensitive Discount, which is subtracted from the basic charge

- PCF or Premium Concentration Factor, which is a multiplicative adjustment

Here's an example of the R5 calculation from Odomirok similar to the R4 example from the previous section. It provides the annual statement locations for the various amounts that are needed for the R5 calculation. It's probably good to scan it. (It's mostly Schedule P. Some of the amounts are provided by the NAIC.)

| Now you're ready to tackle a full R5 problem! |

Take a quick look at the official statement of the 2014 problem before you look at my solution: (note there were 2 errors in the statement of the problem - see examiner's report)

- E (2014.Fall #18)

Note that the examiner's report answer to part (c) is now outdated. Interest rate risk and catastrophe risk were not taken into account by the RBC formula prior to the 2019 update of Odomirok. Both these risk are now considered in the RBC formula. (shout-out to luo!)

Anyway, here's my solution to the calculation of R5 for that problem. (Once you have R5, calculating the total RBC is easy because they directly give you R0 thru R4.) I've included a lot more explanatory details than were in the examiner's report:

And finally, here are 4 PDFs with practice problems similar to the 2014 exam problem but with different numbers: (It should be self-explanatory)

Note 1: These 4 problems were generated with random numbers and problem #2 had a negative base RBC charge for WC. This negative charge for WC should probably be set to 0 before combining it with the charges for the other lines.

Note 2: In the above problems, you were given the $-value for the excessive growth charge, but it's possible you may have to calculate it from the raw data. Recall from the previous section on calculating R4 I said the excessive growth charge for R4 is almost exactly the same as for R5. Well, you can see that clearly in the 2 formulas below:

Formula: (excessive premium growth charge for R4) = (excess growth) x 0.450 x (net loss & LAE reserves)

Formula: (excessive premium growth charge for R5) = (excess growth) x 0.225 x NWP

- ==> (excess growth) = (average growth over last 3 years) – 10%

- ==> (average growth over last 3 years) is capped at 40% for each year

The hard part of the calculation (and it really isn't that hard) is the value for (excess growth). Once you have that, the corresponding charge is easy using the above formulas. Here's a pop quiz that shows you how to do it.

Pop Quiz F! :-o

- Given:

- (Should use total GWP from the FIVE-YEAR HISTORICAL EXHIBIT discussed in Odomirok.12-5yr but if only NWP is given, as in E (2018.Spring #18), then use NWP but note the assumption of no reinsurance.)

- Given:

year GWP 2016 100,000 2017 120,000 2018 174,000 2019 191,400

- Calculate the NWP excess growth charge.

Pop Quiz F Answer! :-D

- (average growth over last 3 years)

- = average (120000/100000 - 1 , 174000/120000 - 1, 191400/174000 - 1)

- = average (20%, 45%, 10%) (but the growth must be capped at 40%)

- ~ average (20%, 40%, 10%)

- = 23.3%

- (average growth over last 3 years)

- excess growth charge

- = (excess growth) x 0.225 x NWP

- = (23.3% – 10%) x 0.225 x 191,400

- = 5,742

- excess growth charge

Note that if the average growth over the last 3 years is less than 10% then the excess growth charge should be set equal to 0. (The excess growth charge cannot be negative.)

There is a web-based practice template for R5 in the next quiz, but here's a good practice problem from an old exam. There are 3 twists in this problem which are explained below.

- E (2019.Spring #15)

Twists

- There are 2 lines of business. That means you have to apply equations 4 and 5 separately to each line then calculate the combined total RBC charge using equation 6.

- You have to calculate the excessive growth charge yourself, but it's easy. Just follow the example above

- You have to calculate the company L+LAE 10-year average yourself, which is easy because they give you the 10-year history from Schedule P, BUT you also have cap the L+LAE for each year at 300%. As explained in Odomirok: The company average loss and LAE ratio is a straight average over the past 10 accident years of the net loss and LAE ratios provided in Schedule P, Part 1, column 31. Loss and LAE ratios for any accident year in excess of 300% are capped at that value in consideration of anomalous, one-time results. ← shout-out to AU!

Quiz:

mini BattleQuiz 6 You must be logged in or this will not work.

Week 3: Day 1 (Catastrophe Risk)

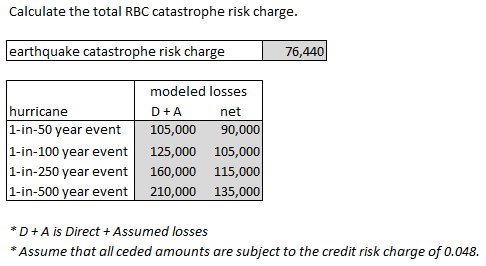

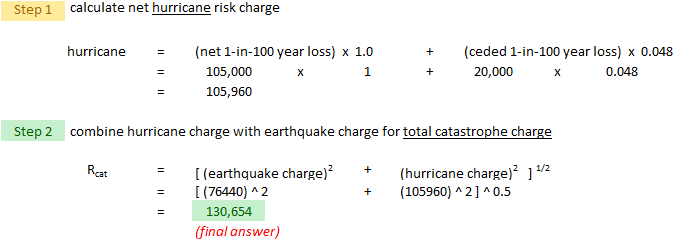

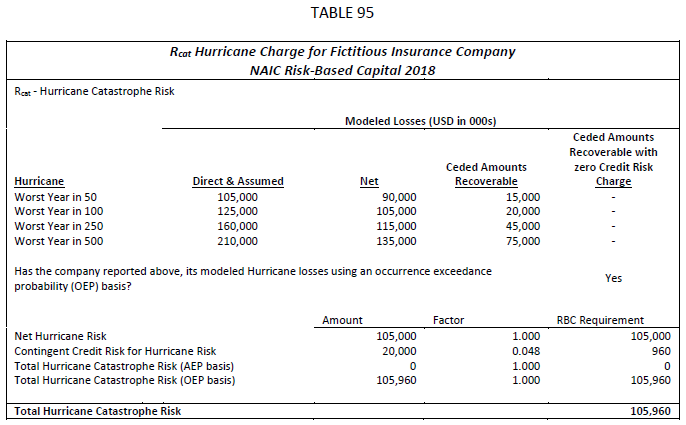

Calculating the RBC catastrophe risk charge Rcat is the same calculation for earthquake and hurricane. Here's what you need:

- estimated net & ceded losses for 1-in-50 year, 1-in-100 year, 1-in-250 year, 1-in-500 year catastrophe events (for filing purposes - see table below)

- → but only the 1-in-100 year event is used in the Rcat calculation

- net catastrophe risk factor = 1.00 (apply to net 1-in-100 year event)

- contingent credit risk = 0.048 (apply to ceded 1-in-100 year event to account for credit risk related to reinsurance recoverables)

The loss estimates are obtained from catastrophe models but the mechanics of this are beyond the scope of the syllabus. Anyway, once you've got the RBC charge separately for both earthquake and hurricane, the final Rcat charge is:

The text has an example for both earthquake and hurricane but the method is exactly the same. If I were solving this problem on an exam, here is how I would do it. You can compare this with the more detailed example from the text further down.

| Alice's abbreviated statement of the problem... |

| Alice's abbreviated solution... |

| And here's the more detailed text version of just the hurricane portion... |

The text discusses other details that I would only skim if I were studying for this exam. You can consult the source text for a little more information on these topics but I doubt you need to know more than what I've listed below:

- reporting of projected catastrophe losses: can be done on an Aggregate Exceedance Probability (AEP) basis, or Occurrence Exceedance Probability (OEP) basis

- exemptions from filing catastrophe charges: granted when certain conditions are met that indicate a low net catastrophe exposure such as when coverage is less than 10% of policyholder surplus

- credit risk charge: losses ceded to U.S. affiliates and mandatory pools (whether authorized, unauthorized or certified) are not subject to the 0.048 credit risk charge

Here are a couple of practice problem that shouldn't take you more than just a few minutes:

Week 3: Day 2 (Operational Risk)

This was discussed earlier in the section Trend Test and Risk Categories, but here's a quick review:

Operational risk is easy to calculate because the basic charge is 3% of the pre-operational risk RBC total. Operational risk considers the risk of financial loss resulting from operational events that have not already been reflected in existing risk charges including:

- inadequacy or failure of internal systems

- personnel

- procedures or controls

- external events

- legal risk

It does not include reputational risk arising from strategic decisions. Note also that this basic 3% charge can be adjusted downward in certain circumstances. According to the source text:

- The operational risk charge is further reduced by the sum of offset amounts reported by directly owned life insurance company subsidiaries that prepare and file the Life RBC calculation, adjusted for the percentage of ownership in the directly owned life insurance company subsidiaries (but not to produce a charge that is less than zero).

Alice's Summer Performance Review (Old Exam Problems)

mini BattleQuiz 7 You must be logged in or this will not work.

Full BattleQuiz You must be logged in or this will not work.

Pop Quiz B Answers

- (a) BSF = 1.500 for 10 issuers

- (b) BSF = 1.006 for 85 issuers ← for a hint, see here (shout-out to amberxmc!)

- (c) BSF = 0.750 for 120 issuers

- (d) BSF = 0.126 for 575 issuers

Pop Quiz C Answers

- (a)

- basic R1 charge = (8,000 x 0) + (1,000 x 0.003) + (2,000 x 0.01) + (3,000 x 0.3) + (5,000 x 0.05) + (3,500 x 0.05) = 1,348

- (use all items in table)

- (b):

- relevant # of bond issuers = (# class 01 issuers) + (# class 02 issuers) + (# class 06 issuers) = 70 + 50 + 90 = 210

- (remember that you only use unaffiliated bond classes 01 → 06, non-U.S. government bonds)

- BSF = 300 / 210 - 1 = 0.429

- (c)

- (assets subject to BSF) = (1,000 x 0.0030) + (2,000 x 0.0100) + (3,000 x 0.3000) = 923

- (remember that you only use unaffiliated bond classes 01 → 06, non-U.S. government bonds)

- BSC = 923 x 0.429 = 396.0