Odomirok.8-9-IS

Reading: Financial Reporting Through the Lens of a Property/Casualty Actuary - Chapters 8/9 - Income Statement & Capital and Surplus Account

Author: Kathleen C. Odomirok, FCAS, MAAA, Liam M. McFarlane, FCIA, FCAS, Gareth L. Kennedy, ACAS, MAAA, Justin J. Brenden, FCAS, MAAA, EY

VIDEO → (5:00) → Income Statement - General Overview (Click here for all currently available videos.)

VIDEO → (7:00) → Statutory Surplus - General Overview ← This video is from Feldblum.Surplus but is a good companion video for this material.

| BA Quick-Summary: Income Statement & Capital and Surplus Account

The statutory income statement details:

The capital and surplus account, which reconciles the beginning and ending surplus for the reporting period and highlights various adjustments that impact surplus directly such as:

|

Contents

Pop Quiz

Multiple Choice (mini BattleQuiz 7) ← for general review of topic

Study Tips

The balance sheet and income statement are 2 of the 5 statements in a completed set of financial statements. Of the 2, the income statement is much more heavily tested on Exam 6 which is why we cover it first. To cover it properly, however, we need some basic information about the balance sheet (and accounting concepts in general.) This basic information is covered in the first couple of sections of this wiki article and refers to Odomirok.6-7-BS.

Estimated study time: several days (not including subsequent review time)

BattleTable

Based on past exams, the main things you need to know (in rough order of importance) are:

- surplus: calculation of surplus, surplus changes, non-I/S surplus changes & reasons for surplus changes

- statutory income: calculation of statutory income

- basic accounting terms and concepts: (SAP = Statutory Accounting Principles)

- => balance sheet, income statement, assets, liabilities, revenue, expenses, reinsurance

- calculation of bond values

| Questions held out from Fall 2019 exam: #11, 13. (Skip these now to have a fresh exam to practice on later. For links to these questions, see Exam Summaries.) |

reference part (a) part (b) part (c) part (d) E (2019.Spring #9) statutory income:

- calculate U/W incomestatutory income:

- calculate inv incomebonds & derivatives:

- SAP treatment 4E (2019.Spring #10) surplus:

- calculate surplus 5NAIC.IRIS NAIC.IRIS E (2018.Fall #14) net losses unpaid:

- calculatenet losses incurred:

- calculatenet U/W gain (loss):

- calculateE (2018.Fall #11) investment income:

- calculateU/W income: 2

- calculatePDR:

- when is PDR ≠ 0E (2018.Fall #10) Odomirok.6-7-BS surplus:

- calculate surplussurplus:

- impact on surplus 3E (2018.Spring #10) statutory income:

- calculateexpense allocation:

- impact on profitabilityexpense allocation:

- actuary's involvementE (2017.Fall #9) statutory income:

- calculateusers & purpose:

- B/S & I/S 1E (2017.Fall #10) surplus:

- calculate surplusE (2016.Fall #14) surplus:

- calculate surplusfinancial health:

- evaluateE (2015.Fall #15) surplus:

- non-I/S surplus changessurplus:

- total surplus changesurplus:

- reasons for surplus chgE (2014.Fall #12) surplus:

- calculate surplussee NAIC.IRIS see Odomirok.10-Notes E (2013.Fall #19) SAP:

- identify errorssurplus:

- calculate surplusreinsurance:

- reasons to purchaseregulator concerns:

- fair valueE (2012.Fall #14) surplus:

- impact on surplussee Odomirok.19-RBC

- 1 B/S stands for Balance Sheet, and I/S stands for Income Statement.

- 2 There is a weird "trick" in sample answer 2 for part (b) in the examiner's report. It is discussed further down in this wiki article for a different exam problem Statutory Income 2017.Fall #9. The "trick" is that the change in certain balance sheet items, like provision for reinsurance, is defined as (prior – current) rather than the usual (current – prior).

- 3 Part (c) requires basic knowledge of subsequent events which is covered in NAIC.SSAP-9.

- 4 See this forum discussion for more on derivatives and hedge accounting.

- 5 There may be an error in the examiner's report solution to part (a). See this forum discussion on the calculation of the UEPR liability (Unearned Premium Reserve).

Full BattleQuiz You must be logged in or this will not work.

In Plain English!

If you've taken a university course in accounting then you're in good shape because you're already familiar with the layout of financial statements. If you haven't, it's not a great problem, but it might be a little harder to understand the big picture.

Some of the content in this wiki article is from other chapters of Odomirok. It's basic accounting material but since we're covering the chapters in a different order, I just threw it in here.

SAP versus GAAP

This section is an intro to SAP versus GAAP. Before doing anything else, you need to know the frameworks that companies use for accounting. (More details are covered in SAP versus GAAP - Chapter 22-23)

Question: define SAP and GAAP

- Both are frameworks of accounting principles/rules for reporting financial transactions and operating results:

- ==> SAP: prescribed by an insurer’s domiciliary state

- ==> GAAP: used by all public companies

Obviously there is a difference between how insurers and non-insurers do their accounting.

Question: why do insurers follow different accounting rules versus non-insurers [Hint: intended user & purpose]

- ==> SAP:

- used by regulators

- primary concern is solvency

- SAP is more conservative (protects policyholders)

- ==> SAP:

- ==> GAAP:

- used by investors/creditors

- primary concern is measurement of earnings

- ==> GAAP:

That's all well and good, but what do we mean when we say SAP is more conservative? Well, GAAP came first and SAP evolved from GAAP to satisfy the specific goal of monitoring for solvency.

Question: identify 3 important differences between SAP and GAAP

- The answer is covered in detail in another chapter of Odomirok, Chapter 22/23 SAP vs GAAP, but just to give you a taste, here are a few important differences: [Hint: ART]

item SAP treatment GAAP treatment Asset recognition asset is recognized when expense is incurred may defer recognition to achieve matching of revenue & expenses 1 Reinsurance in loss reserves loss reserves are recorded NET of reinsurance loss reserves are recorded GROSS of reinsurance Taxes taxes (mostly) not deferred (see SAP Taxes) tax can be deferred

- 1 An example of GAAP asset recognition to achieve matching of revenue & expenses is for DAC (Deferred Acquisition Costs). Acquisition costs like advertising are not "counted" immediately. Rather they are earned over the term of the policy that was acquired by that particular advertising.

mini BattleQuiz 1 You must be logged in or this will not work.

Elements of Financial Statements

If you google "elements of financial statements" you'll find many websites that list the 5 elements as follows:

- Assets (Ex: cash, investments)

- Liabilities (Ex: loss reserves)

- Surplus or Equity (= net assets = assets minus liabilities)

- Revenue (Ex: premiums)

- Expenses (Ex: salaries, advertising)

Now, the 5 statements in a completed set of financial statements are listed below: (The red items above relate to mainly to the Balance Sheet, while the green items relate mainly to the Income Statement)

- B/S or Balance Sheet (Statement of Financial Position – Chapter 7 in Odomirok)

- I/S or Income Statement (Statement of Financial Performance – Chapter 8 in Odomirok)

- Capital & Surplus (shows changes in surplus not recorded in the income statement)

- Statement of Cash Flow (shows the inflow and outflow of cash & cash equivalents)

- Notes to Financial Statement (quantitative & qualitative disclosures - Chapter 10 in Odomirok)

These are different but related to the 5 elements.

We're not going to delve too deeply into all of this, but here are couple of basic definitions:

- Balance Sheet: shows a company's assets, liabilities and equity at a specific point in time

- - shows strength of a company's capital (whether assets are sufficient to cover liabilities and remain solvent)

- Income Statement: shows a company's revenue and expenses over a particular period

- - shows company's current profitability (a company could have strong capital based on strong prior performance but weak current performance ==> could indicate impending insolvency)

Notice that the Balance Sheet shows the first 3 elements: assets, liabilities, equity, and the Income Statement shows the last 2: revenue, expenses. Everything fits together nicely! Here's an example of each. (You might want to first duplicate the tab so you can have the wiki and the exhibit open at the same time.)

- Spend a minute or two looking at it and observe:

- The Balance Sheet consists of 2 pages: 1 page shows assets, the other page shows liabilities & equity

- Note the columns for admitted assets and non-admitted assets.

- Line 37 on the second page shows Surplus as regards policyholders which is something you have to calculate in exam problems. (see BattleTable above)

- Spend a minute or two looking at it and observe:

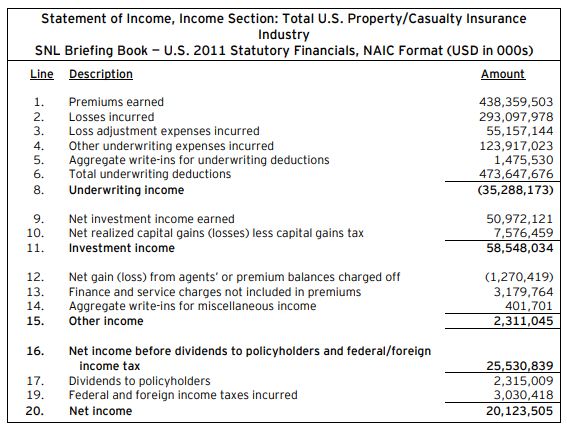

- There are 3 types of income: U/W income, investment income, other income

- Note that Liberty's U/W income on line 8 is negative 807 million, which means their COR must be over 100%.

- But their total net income on line 20 is positive 823 million. (Their investments save them! See line 11.) Pay special attention to line 20 because you had to calculate this on exam problems.

- The item "dividends to policyholders" is subtracted from total income. (This is important later in the web-based problem based on (2017.Fall #10))

- There are 3 types of income: U/W income, investment income, other income

- Capital & Surplus Account: This is shown below the 3 types of income.

- These line items are direct charges to surplus that do not flow through income.

- The item "dividends to stockholders" is subtracted from surplus (but not from income)

- Capital & Surplus Account: This is shown below the 3 types of income.

| It also might be an idea to look at Odomirok.6-7-BS for some extra background information about the balance sheet. |

Note: There is a "matching-type" problem in this mini BattleQuiz where you have to identify the location of particular line items in the financial statements. You should do that particular web-based problem MANY, MANY TIMES. Often on an exam problem, you're given financial statement information and you have to know where in the annual statement each item comes from. Sometimes it's obvious (like Cash is from the asset side of the balance sheet) but sometimes it isn't. For example, do you know where Federal and foreign income taxes incurred is located? It's in the Income Statement under Other Income. Or how about Current federal and foreign income taxes? It sounds a lot like the last one but this one is a liability from the balance sheet. It can be very confusing and you probably won't have much time to think about it on the exam. The only way to learn it is to practice it a about a googelplex number of times so it becomes second nature. And if you think I'm kidding, I'm not. How many times do you want to take this exam? 😉 If the answer is once, then you gotta practice the calculations and memorize the facts like an absolute maniac. That goes for the whole syllabus, but especially the top 24 articles.

mini BattleQuiz 2 You must be logged in or this will not work.

Statutory Income (2018.Spring #10a)

| Sept 28, 2024: Minor edits were made to this section for clarity. |

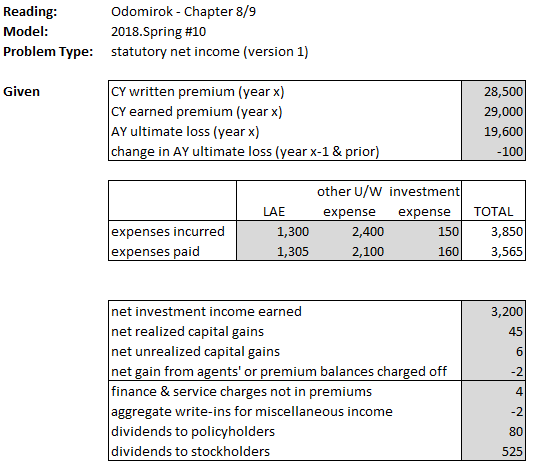

In this section we're going to solve the following exam problem:

- E (2018.Spring #10a)

But first take a quick look at the table of income statement items shown below. In particular, note the 3 components of income:

- [8] Underwriting Income

- [11] Investment Income

- [15] Other Income.

These sum to:

- → [16] Net Income (before dividends & taxes)

Then the final result, after deducting dividends & taxes is:

- → [20] Net Income

This table encapsulates what you need to understand for the 2018-Spring exam problem referenced above.

We're only going to look at part (a) since that's a calculation. (Parts (b) & (c) of this problem are short answer and you can easily get the answer from the examiner's report or the mini BattleQuiz.)

Statement of Problem (slightly simplified)

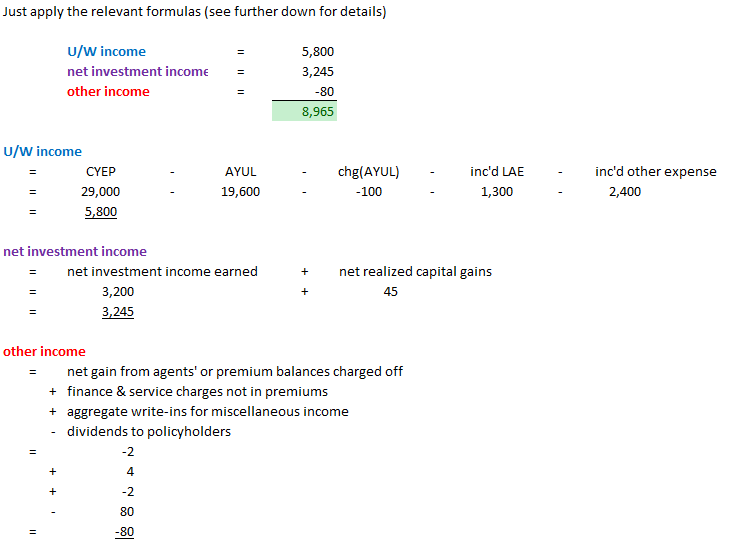

Solution

There is a similar web-based "infinite practice problem" in the next mini BattleQuiz. Remember that you can copy the data from the web page into Excel, then solve the problem in Excel and copy your answers back into the web page for computer scoring.

| Below are some formulas to keep in mind.

Note: There are inconsistencies between the Odomirok's CAS Financial Reporting Text and the standard SAP Income Statement. It appears that the Odomirok text states an incorrect formula, but anything from the source text should be accepted as correct even if it is not correct. |

item formula U/W income = EP – (current AY loss) – (change in prior years' AY loss) – LAE – (other U/W expense) 1 = EP – (current AY loss & LAE) – (change in prior years' AY loss & LAE) – (other U/W expense) 1a

net investment income earned

(from Odomirok text)= (Interest and Dividends received on investment assets held over the course of the year)

→ This amount is net of investment expenses and other costs, but gross of federal income taxes, on the income statement.investment income

(from Odomirok text)= (net investment income earned) + (net realized capital gain (loss)) - (This formula appears to be an error in the source text since statutory accounting should not include realized capital gains. This formula however appeared in the exam problem E (2018.Spring #10a) where the correct answer used this formula. Answers from the official source texts should be marked correct, even if the information is wrong.)

investment gain

(from income statement)= (net investment income earned) + (net realized capital gains(loss)) – (capital gains taxes) 2a

.net investment income = (investment revenue) – (investment expenses) – (non-federal TLF) 2 other income = SUM(agents' balances charged off, service fees, aggregate write-ins) TOTAL net income = (U/W income) + (net investment gain ) + (other income) – (dividends to policyholders) – (fed/foreign taxes incurred) 3

- 1 SAP uses incurred expenses (not paid expenses because incurred is more accurate than paid)

- → Use version 1 of the U/W Income formula for E (2018.Spring #10a) because the LAE is given as a single number.

- 1 SAP uses incurred expenses (not paid expenses because incurred is more accurate than paid)

- 1a This version of the formula treats Loss and LAE the same way but the information must be provided in that format.

- → Use version 1a of the U/W Income formula for of E (2016.Spring #18b) because loss & LAE are given in the same format.

- 1a This version of the formula treats Loss and LAE the same way but the information must be provided in that format.

- 2 Investment revenue excludes realized capital gains AND excludes unrealized capital gains

- 2a by definition: (net investment income earned) is already net of expenses and in this problem also net of taxes

- (there is a helpful forum discussion on the difference between "investment income earned" and "investment gain".)

- 3 If you look at the given information in the exam problem, all of the little items in the bottom box (below unrealized capital gains) are included in the income calculation except dividends to stockholders. Normally you would also have to subtract federal & foreign income taxes, but this is not provided in the given information.

Sometimes you're not given EP directly. You may instead be given WP and the change in UEP (Unearned Premium) and then have to calculate EP for the current year. Note also that UEP is also sometimes denoted UPR (Unearned Premium Reserve)

item formula EP = WP – (change in UEP)

Side point: The question specifically asked for statutory income. That would be the income as defined by SAP (Statutory Accounting Principles). Recall that SAP is specifically for insurance companies and all the calculations we'll be doing will be according to SAP.

There is another old problem that asks you to calculate statutory net income but it's harder. It involves the concept of policyholder's surplus. It will make more sense once we've covered other problems that specifically ask you to calculate policyholder's surplus. Here's the link if you want to take a quick look but don't worry if you don't know how to solve it yet:

- E (2017.Fall #9a)

Then part (b) of that problem is pretty easy. They ask you to identify a user of the balance sheet and a user of the income statement, but both have almost the same answer! The only difference is that the income statement lists competitors as a user whereas the balance sheet doesn't. The actual use of each exhibit is easy and was covered earlier in this wiki article.

mini BattleQuiz 3 You must be logged in or this will not work.

Surplus (2017.Fall #10)

Here is a second problem from the same exam, but here you have to calculate the policyholder's surplus. It's actually a very good problem because it directly teaches you how to do the calculation. The solution in the examiner's report is also nicely written. The link is provided below. Study the solution then see if you can do the 2 practice problems.

Tips from BA user mec06e:

|

- E (2017.Fall #10)

And here are the practice problems. (Just like the exam problem but with different numbers!)

The mini BattleQuiz has a practice template based on this problem. To summarize, if NI = Statutory Net Income then use this formula to calculate surplus:

(surplus) CY = (surplus) CY-1 + (NI) CY + (direct charges to surplus) CY

Now, the prior year surplus, (surplus) CY-1, is usually given. That means you have to calculate the other 2 terms in the formula:

- (NI) CY: Use the formulas from the previous section.

- (direct charges to surplus) CY: The items that are not part of (NI) CY are direct charges. Here you calculate the change in value from CY-1 to CY. The catch is that you have to remember which changes are added (unrealized capital gains, deferred tax), and which are subtracted (provision for reinsurance, non-admitted assets).

Another problem that's similar is part (a) the following. It's also included in the mini BattleQuiz:

- E (2016.Fall #14)

Yet another similar problem from 2019.Fall is given below but there are a couple of important differences. The hardest part of the problem is calculating surplus but what they ask for is the Total Assets. Once you have the surplus, all you have to do is rearrange the standard formula:

- Surplus = Net Assets - Liabilities = (Total Assets – Nonadmitted Assets) - Liabilities

The other trick in this problem is inclusion of a line item for surplus notes. You must include the change in surplus notes when calculating surplus.

- E (2019.Fall #12)

Now you're ready for the quiz...

mini BattleQuiz 4 You must be logged in or this will not work.

Statutory Income (2017.Fall #9)

Let's return now to another problem that asks you to calculate statutory net income:

- E (2017.Fall #9)

It's quite different from the other problem on statutory net income and we need some extra facts. Note that according to the first page of Chapter 9 of Odomirok (Capital & Surplus Account) direct charges to surplus consists of 3 main items:

- other surplus changes (includes 6 separate items, 4 of which came up in the exam problem above.)

- additional capital contributions (includes change in surplus notes and change in gross paid-in & contributed surplus)

- stockholder dividends

The 6 items under other surplus changes are: (items in red are subtracted)

- changes in unrealized capital gains

- changes in unrealized foreign exchange

- changes in deferred income tax

- changes in nonadmitted assets

- changes in provision for reinsurance

- cumulative effect of changes in accounting principles

Pop Quiz! :-o

- See if you can solve part (a) of the above exam problem with your current knowledge. (I'm assuming you've done the previous mini BattleQuizzes and are proficient with the practice templates that were covered there.) There is something you need to watch out for however:

Watch out!! Normally the change in a quantity is calculated as:

(current year value) – (prior year value)

BUT for the 2 "other surplus items" in red above, the exam question lists the changes backwards as:

(prior year value) – (current year value).

- The reason for this madness is that if you look at the section for Capital & Surplus Account on the Income Statement, these sign reversals allow you to simply sum lines 22-37 to get the total change in surplus on line 38. Otherwise you'd have a more complicated formula for line 38 that would involve treating lines 27 & 28 differently by subtracting them instead of adding them. (line 27: nonadmitted assets, line 28: provision for reinsurance).

Here are 2 practice problems. (Just like the exam problem but with different numbers!)

mini BattleQuiz 5 You must be logged in or this will not work.

Exam Problems

mini BattleQuiz 6 You must be logged in or this will not work.

Full BattleQuiz You must be logged in or this will not work.