Feldblum.Ratings

Reading: CAS Study Note, October 3, 2011, pp. 1-7 and 14-15 (stop at Best’s Capital Adequacy Ratio) and Appendix A.

- Candidates are not responsible for Section 4, Section 5 beginning at Best's Capital Adequacy Ratio on p. 15, Appendices B-D, and the endnotes.

Author: Feldblum, S.

Forum (Or click here for Legacy Forum – no longer monitored)

VIDEO → (6:15) → Rating Agencies - General Overview (Click here for all currently available videos.)

BA Quick-Summary: Feldblum - Rating Agencies

|

Contents

Pop Quiz

Study Tips

This reading is straightforward and the amount of memorization is reasonable. Check the notes in the [| Battle Table] for the high-value items.

Estimated Study Time: 1 hour (not including subsequent review time)

BattleTable

(We'll be using the term Rating Agency frequently in this wiki article so let's use the abbreviation RA.)

Based on past exams, the main things you need to know (in rough order of importance) are:

- the importance of RAs to insurers [Hint: USE]

- identify & describe the capital models used by the 3 main rating agencies

- miscellaneous facts about interactive rating and rating agencies

- the notion of RA as regulator - are the rating agencies effectively acting as regulators of the insurance industry

| Questions held out from Fall 2019 exam: #5. (Skip these now to have a fresh exam to practice on later. For links to these questions, see Exam Summaries.) |

- Outdated questions are highlighted in orange.

reference part (a) part (b) part (c) part (d) E (2018.Fall #4) importance of RAs:

- to insurers vs grocersimportance of RAs:

- to reinsurersrating agency methods:

- stability vs responsivenessdisclosure to RA:

- of damaging dataE (2017.Spring #2) importance of RAs:

- to policyholders, insurersincentives for RAs :

- for accurate modelsincentives for RAs :

- for high/low capital stdscapital models:

- RA vs RBC 1E (2015.Fall #5) interactive rating:

- describeinteractive rating:

- ads/disads for insurerRA as de facto regulator:

- argue for/againstE (2015.Spring #2) RA as de facto regulator:

- true? explainRA as de facto regulator:

- false? explainE (2015.Spring #6) mass tort exposure:

- RA assessment & IRISmass tort exposure:

- reinsurer downgrademass tort exposure:

- ads/disads of settlementE (2013.Fall #7) importance of RAs:

- to insurersinteractive rating:

- vs public ratingsdisclosure to RA:

- of damaging datacapital models:

- describe & defendE (2012.Fall #3) importance of RAs:

- to insurerscapital models:

- state vs A.M. Best 2solvency monitoring:

- procedures

- 1 The second bullet point in the answer in the examiner's appears to be wrong. It refers to RBC as using a "worst-case year", presumably referring to how the industry RBC percent factor was chosen. But this was changed in 2008 from "worst-case" to using the 87.5% percentile. So you should probably ignore that answer. There are plenty of other differences you can list.

- 2 One of the answers in the examiners' report is now outdated. RBC now does consider catastrophe risk and interest rate risk.

Full BattleQuiz You must be logged in or this will not work.

In Plain English!

Intro

You only have to know about 10 pages (pages 1-7, pages 14-15) + Appendix A.

Question: why do we bother with financial strength ratings at all

- for policyholders:

- - financial strength ratings help buyers assess an insurer's ability to pay claims

- - if the potential policyholder is an insurer seeking reinsurance, the insurer may require the reinsurer have a high rating

- for P&C insurers:

- - a high rating can help insurers get business

- - a financial strength rating by a rating agency can uncover potential solvency issues without involving a regulator

Ok, now we know the why but we also need to know the who and the how

Question: who does financial strength ratings

- A.M. Best:

- - has the most experience with financial strength ratings of insurers

- Moody's:

- - focuses more on debt ratings (versus overall financial strength ratings)

- S&P (Standard & Poor's):

- - focuses more on debt ratings (versus overall financial strength ratings)

Question: how are financial strength ratings done

- All 3 agencies use something called interactive rating as an overall methodology (discussed later) but they differ in their specific rating or capital model (also discussed later.)

Let's finish up the intro with a couple of key points regarding the reliability of rating agencies:

Question: how do rating agencies ensure consistency across insurers

- standard information-gathering & assessment guidelines

- ratings are related to economic capital

- analysis & final rating should be issued by separate bodies.

It's important to realize that rating agencies are not perfect. If they were, we never would have had the financial crisis of 2007-2008.

Question: describe shortcomings of rating agencies

- conflict of interest

- - rating agencies are paid by the companies they rate (how dumb is that?!!!)

- history of unreliability

- - rating agencies have given high ratings to companies that then went bankrupt. (Example: Enron Scandal)

mini BattleQuiz 1 You must be logged in or this will not work.

Interactive Rating

In the previous section we learned that rating agencies use a process called interactive rating when evaluating the financial strength of an insurer. It is a comprehensive qualitative & quantitative analysis.

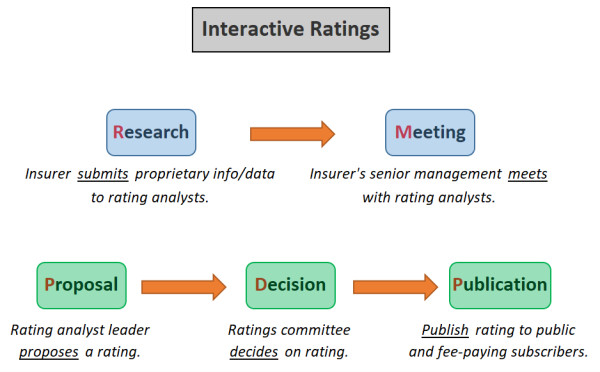

Question: describe the 5 steps of the interactive rating process [Hint: RM-PDP]

- Research: by ratings analysts (insurer submits proprietary info)

- Meeting: between rating analysts & insurer's senior management for presentations

- Proposal: the rating analyst leader proposes a rating (insurer may submit further info)

- Decision: by ratings committee

- Publication: to public & fee-paying subscribers

Here's a flowchart representing the interactive rating process:

You can see that these 5 steps should indeed provide a comprehensive evaluation of the company. This is part of the reason for placing a high degree of trust in rating agencies. But this methodology also has drawbacks: [Hint: it TIEs up company resources]

- Time-consuming: requires extensive meetings with senior management

- Intrusive: insurer must provide detailed operational info

- Expensive: insurer must pay for rating agencies to do the interactive ratings

Question: if interactive ratings are such a royal pain, why do insurers bother with them [Hint: USE]

- Unrated insurers: agents are wary of unrated insurers

- Solvency assessment: 3rd parties such as regulators or investors may rely on a rating agency's assessment

- Efficiency: agents, underwriters, regulators don't have the expertise to evaluate the financial strength of an insurer

An example where a rating is important is reinsurance because if downgraded to below investment grade, a reinsurer may not be able to renew its treaties and thus lose business.

Question: if rating agency concludes that an insurer's financial strength has changed in a material way, what reporting options are available

- downgrade or upgrade insurer's rating

- change the outlook (do not upgrade or downgrade)

- → rating agencies hesitate to change ratings too quickly to avoid angering paying clients and to maintain consistency & reputation

mini BattleQuiz 2 You must be logged in or this will not work.

Capital Models

The interactive rating includes a lot of qualitative information-gathering. Let's now look at their quantitative capital models on a high level.

- A.M. Best is no longer covered on the exam and is highlighted in orange in the table below to indicate this.

Rating Agency General Description of Method Detailed Description Other A.M. Best EPD (Expected Policyholder Deficit) EPD = $P / $V 1 SELECTION: choose required capital so that EPD = 1% Moody's stochastic cash flows to model economic capital repeated simulations of loss distributions of separate risks TIME HORIZON: project cash flows until liabilities are settled Std & Poor's PB (principles-based) models & ERM 2 practices evaluate insurer's (ERM, internal capital model) RATING: weighted avg of (S&P, insurer) capital assessment

- 1 $P = pure premium for treaty, $V = market value of reserves

- 2 ERM is Enterprise Risk Management

There are several old exam problems in this next quiz that ask you compare state evaluations of capital adequacy (usually RBC) with evaluations by rating agencies. There are good problems because they tie together different parts of the syllabus.

mini BattleQuiz 3 You must be logged in or this will not work.

Appendix A

Appendix A explains rating schemes for:

- financial strength for insurance companies

- credit quality for bonds

Interestingly, A.M. Best has recently changed their financial strength rating system. If you go to A.M. Best's website you can get the updated information. Since the rating system is changing, it seems unlikely you'd be asked any questions on the old system. According the outdated information in Feldblum, A.M. Best divides insurers into 2 categories:

- Secure: likely to meet their obligations (divided further into 3 sub-levels)

- Vulnerable: may not meet their obligations in adverse scenarios (divided further into 7 sub-levels)

Compare this to their credit quality ratings, which also have 2 main categories:

- investment grade: 4 levels (+ sublevels)

- non-investment grade: 4 levels (+ sublevels)

That's about it. You can glance at the source reading, but there is nothing else there aside from the names of all the different sublevels.

Remaining Exam Problems

mini BattleQuiz 4 You must be logged in or this will not work.

Full BattleQuiz You must be logged in or this will not work.