Excel Practice Problem_IEE.IG2

I am a bit confused about S_A and m(S_A). In IEE.IG2 tab, do I need to calculate surplus for PY & CY and then average or just use CY_NEP to get m(S) as solution given?

Please see my attachment yellow highlight calculation for more details. Thanks!

Comments

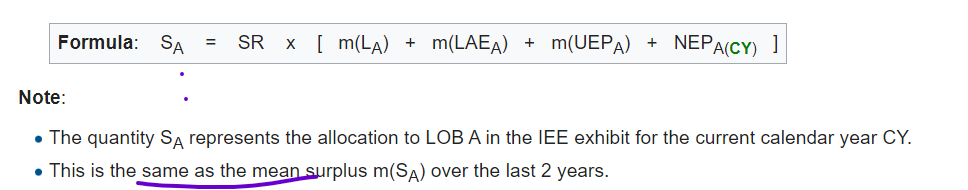

The source text is a little confusing on this point as it seems to conflate the mean surplus over the last 2 years with the allocation of surplus to line of business for the current year.

Here's a breakdown of the key points:

So, the mean surplus is used to derive a ratio, which is then applied to current year figures to allocate the surplus by line of business. This process ensures that the allocated surplus reflects both historical data and current year specifics, although it might appear to conflate the two.

Does that answer your question?

Does your answer conflict with the answer provided in FA 2015 Q#13? The question asks for "the amount of PHS that would be allocated for 2014: " yet the answer looks to be mean the mean surplus allocated by the surplus ratio.

In general, it seems that for these types of questions (where surplus ratio is to be calculated), they are always asking for the 2 yr average of PHS allocated to a LOB?

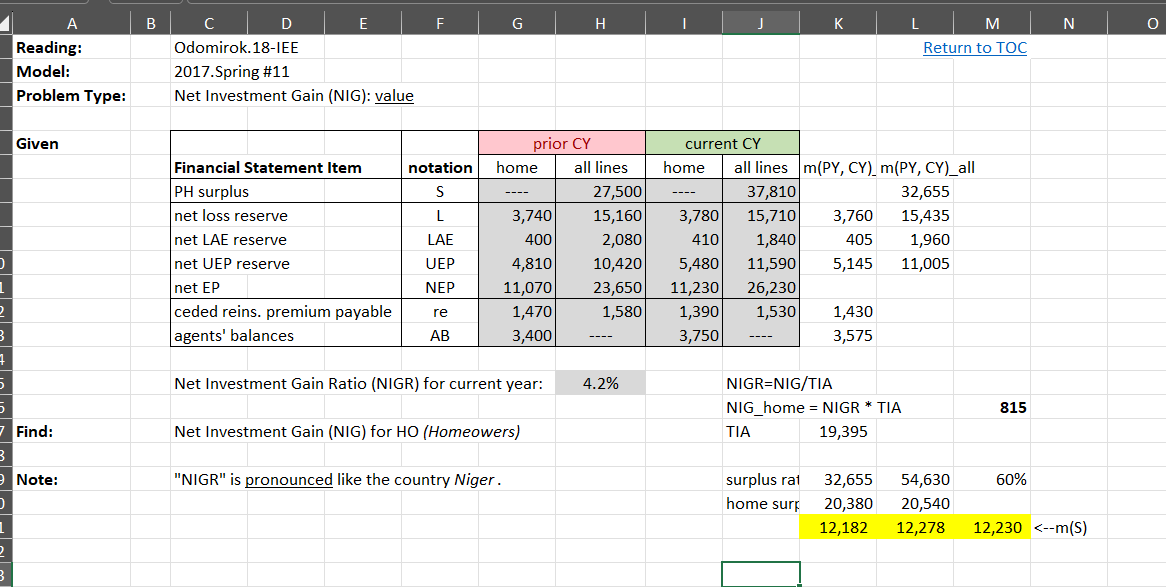

Excel practice problem IEE.IG1:

In TIA calculation, m(S) is the mean of prior and current year surplus.

Excel practice problem IEE.IG2:

In TIA(H) calculation, m(S-H) is the Home current year surplus allocation.

Do we always use surplus allocation when calculating specific LOB?

danwang0509, you use mean surplus when allocating surplus to a specific LOB.

I should be more clear on my question:

When we calculate TIA for specific LOB, do we use mean surplus or the current year surplus allocation for that LOB?

It looks like IEE.IG1 is using mean surplus, and IEE.IG2 is using the surplus allocation for Home.

IEE.IG1 does not calculate TIA for a specific LOB.

The surplus component that goes into TIA.home in IEE.IG2 is the mean surplus.

IEE.IG2

TIA(H) = m(L-H)+m(LAE-H)+m(UEP-H)+m(S-H)-m(AB-H)

m(S-H) = SR * (m(L-H)+m(LAE-H)+m(UEP-H)+NEP-H(CY)

m(S-H) here is the Home surplus allocation for current year, not the mean surplus.

m(S-H), as the terminology indicates, is the mean surplus for Home. It feeds into TIA(H) as such. That, in turn, is multiplied by the inv gain ratio to yield Home inv gain for the current year.