Section thought process

Is this section coming from the prospective of the reinsurer? Specifically the beginning of the section where it asks the question about accounting treatment under both perspective and retroactive reinsurance. The reason I ask is that under prospective reinsurance the insurer gets to write reserves net of reinsurance and so it seems like reserves would decrease but under this question it says reserves increase. I just want to confirm since it wasn't really mentioned what perspective the question was referring to.

Comments

Here are more details.

For prospective reinsurance: If an insurer buys prospective reinsurance and a claim occurs, the impact on the insurer's reserves will depend on the terms of the reinsurance agreement. However, in general, the following principles apply:

The insurer's gross reserves will increase by the amount of the claim. This reflects the total amount of the claim, including any portion that is covered by the reinsurer.

The insurer's net reserves will increase by the amount of the claim that the insurer is still responsible for under the reinsurance agreement. This reflects the portion of the claim that the insurer is responsible for paying, after taking into account the portion that is covered by the reinsurer. The net reserves will reflect the insurer's estimate of the remaining liability associated with the claim.

The reinsurer's reserves will increase by the amount that the reinsurer is responsible for under the reinsurance agreement. This reflects the portion of the claim that the reinsurer is responsible for paying. The reinsurer's reserves will reflect the reinsurer's estimate of the liability associated with the claim.

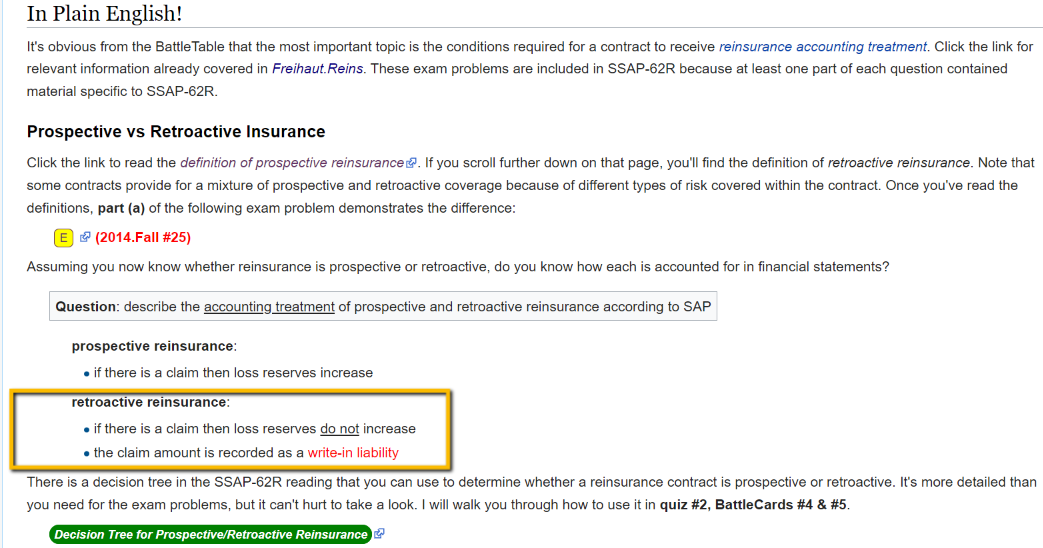

For retroactive reinsurance: Retroactive reinsurance refers to an agreement in which an insurer transfers the risk of claims that have already occurred to a reinsurer. This type of reinsurance is often used to transfer the risk associated with prior-year claims, such as long-tail liability claims. Under SAP, the accounting treatment for retroactive reinsurance is different from that of prospective reinsurance. In the case of retroactive reinsurance:

The insurer recognizes a gain or loss immediately upon entering into the retroactive reinsurance agreement. The gain or loss is based on the difference between the payment received from the reinsurer and the estimated value of the transferred claims.

The insurer records a write-in liability to reflect the potential liability associated with the transferred claims. This liability represents the estimated amount of losses that may be incurred in the future related to the transferred claims. The write-in liability is typically recorded as a separate line item on the insurer's balance sheet, and is not included in the loss reserves.

The reinsurer establishes reserves to reflect the portion of the transferred claims for which it is responsible. This reflects the reinsurer's estimate of the liability associated with the transferred claims.

For Retroactive reinsurance, you mentioned above "The reinsurer establishes reserves to ...". I assume this reserve is not the "regular" reserve, right? It should be non-reserve liability, right? How to record the premium payment the reinsurer received from the ceding insurer? Please advise. Thanks.

The answer is in SSAP 62R, page 10, item 34-k:

_The consideration paid for a retroactive reinsurance agreement shall be reported as a

decrease in ledger assets by the ceding entity and as an increase in ledger assets by the

assuming entity. _

"Consideration paid" means "premium payment the reinsurer received from the ceding insurer."

You need to read paragraphs 34 through 39 to fully understand the accounting treatment of retroactive reinsurance.

But note that Graham did not include this in the wiki note, because he found it mostly did not come up in past exams.

By looking at the account treatments of retroactive reinsurance, it seems that retroactive reinsurance is not really considered as a valid reinsurance. Is there any reason behind?

A sidetrack question, is portfolio reinsurance also a kind of retroactive reinsurance?

Graham has descriptions of both pros. and retro. reins. above. What in there makes you think retro. is not really considered as a valid reinsurance?

Portfolio reinsurance is distinct from retro. reins.. From Odomirok:

Portfolio reinsurance is the transfer of policies in force or liabilities

remaining on a block of the insurance company’s business. Companies tend to enter into

these arrangements when they:

• Want to discontinue writing a certain business

• Would like to get the risk or uncertainty associated with the liabilities off of their

books

• Need surplus relief, which can come in the form of the discounted premium

This is related to Schedule F Part 2, which is not very relevant to actuaries, and not a common exam topic.

Sorry my question is not accurate. Let me restate. Is there any reason causing the accounting treatment of retroactive RI so different from prospective RI while both of them are valid reinsurance?

The difference is claims having occurred versus claims being yet to occur. With the former, you are only reinsuring reserving risk. They may be trying to acknowledge this in the separate accounting treatments.

I'm a little confused because the source reading says that

"The ceding entity and the assuming entity shall report by write-in item on the balance sheet, the total amount of all retroactive reinsurance, identified as retroactive reinsurance reserve ceded or assumed, recorded as a contra-liability by the ceding entity and as a liability by the assuming entity"

In the wiki page, it says that losses are recorded as a write-in liability. What I'm understanding from the source is that the total claims being ceded are recorded as a contra-liability by the ceding company, and any losses or gains after ceding those claims is recognized by an increase or decrease in the statement of income's retroactive reinsurance gain/loss. Additionally, the a write-in item, Special Surplus for Retroactive Reinsurance Account, and also adjusted accordingly on the balance sheet.

Is this correct based on the source? My main source of confusion is the contra-liability vs. liability on the balance sheet, and how future losses/gains from the retroactive contract are accounted for.

This info is in paragraph 34.

This is correct, based on the source.

Liability item is as we know it. Contra-liability item is not quite asset or liability. . .You are not prepared to reduce you liability for it, nor to consider it an asset. Ceded retro gets its own home in it.

The gain/loss may be considered "future," because reserves are for future payments. It is accounted for as you outlined.

Are the answer choices in part a) of this question outdated or something? It seems like it should be retroactive for 60 days and prospective afterwards according to below. Or am I misunderstanding?

I also spent way too long trying to figure this out (instead of spending some of my last hours practicing on the more high-return topics.. sigh 😭), but I feel like it makes more sense and for there to be more support in the COPFLR/SSAP texts that retroactive reinsurance does not affect loss reserve development; loss reserves stay gross of the reinsurance, get a negative write-in liability for any further development and an associated increase in special surplus due to future recoveries from reinsurers above the cost of the reinsurance. It might not be right, which would be unfortunate this late into my studying, but I think there seems to be more support for this as opposed to what's in the wiki.

Was a few seconds too late to edit, but it seems like Cedar supports my hypothesis as well. (Much more clearly too!)

Please identify the question, the part a of which you ask about.

The wiki explains the treatment of retro reins as you describe it (in Odomirok.22-23-GAAP):

Retroactive reinsurance under SAP:

undiscounted ceded reinsurance reserves are recorded as a negative write-in liability (or contra-liability)

Schedule P is unchanged (shows gross of reinsurance)

gain is recorded as a write-in gain [ note: gain = (negative write-in liability) – (cost of reinsurance) ]

==> goes into other income

==> no change to regular surplus because change goes into special surplus

Please explain where you find a difference in the wiki.

Apologies, I was referring to Fall 2017 Q28 a).

In the SSAP 62R wiki:

This description in the SSAP 62R section is not complete, but the elements given are correct.

I will get back to you about 2017.F.28a.